GXO Logistics, Inc.

NYSE: GXO | 05/08/2025

Against a backdrop of whipsawing tariffs and pervasive macro uncertainty, GXO delivered a strong Q1, showcasing the durability of its contractual pure‑play 3PL model and reinforcing the long‑term thesis. As a reminder, the core thesis has four key elements (please refer to previous write-ups for further context):

Reaccelerating organic revenue growth powered by record business wins.

Strong tailwinds benefit GXO as the pure-play 3PL market leader

Expanding EBITDA dollars and margins due to warehouse automation, multi-tenant warehousing, centralized cost-cutting, and synergistic acquisitions.

The market misunderstands the “pass-through” nature of GXO’s business model

GXO shares rose ~+4% on 05/08 after reporting Q1 results ahead of consensus expectations. Revenue of $2.98B (+21.1% Y/Y) surpassed estimates by $50M, and Non-GAAP EPS of $0.29 exceeded by $0.04. Management reaffirmed FY25 guidance:

Organic revenue growth of 3% to 6%;

Adjusted EBITDA of $840 million to $860 million;

Adjusted diluted EPS of $2.40 to $2.60; and

Adjusted EBITDA to free cash flow conversion of 25% to 35%

Amid broader logistics peers announcing shaky guidance tied to macro conditions, the market appreciated GXO’s resilient results and confident guide.

1Q25 - The Positives

New business momentum

Booked $228M of new wins; sales pipeline hit a 3-year high of $2.5B, +13% Y/Y ex-Wincanton.

Finalized largest ever contract win: a 10-year, $2.5B LTV deal with the U.K.’s National Health Service. Healthcare traction continues with Siemens Healthineers contracts in the EU - this serves as direct proof that acquisitions are yielding revenue synergies farther down the line through prior relationships.

Secured $732M of incremental FY25 revenue (all organic, up from $627M in 4Q24) and another $300M for 2026.

New wins continue to support the long-term thesis: Outsourcing tailwinds, market share expansion, and e-commerce growth. 41% of wins are newly-outsourced, 39% include automation, and 42% stem from e-commerce.

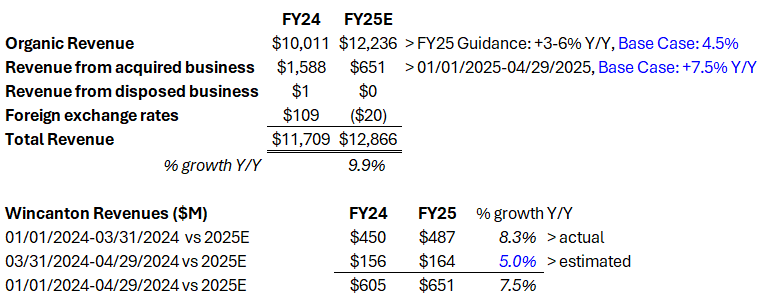

Clarity on Wincanton and U.K. strength

The Wincanton business grew an impressive +8.3% Y/Y in 1Q25, and total U.K. revenue-including organic GXO-rose +52% Y/Y. Q1 volumes were softer than expected, which management attributes to the employment-tax changes introduced earlier in the year; however, they report that activity is already rebounding as Q2 unfolds. With the BoE now engaging in QE as inflation eases, I expect U.K. consumer spending to strengthen: overall spending in March 2025 edged higher, and non-essential card outlays were +2.2% Y/Y. This backdrop should provide a meaningful tailwind for GXO’s U.K. operations, which account for 47% of total sales.

Wincanton CMA review- a decision is expected in the coming weeks, with two scenarios:

Full clearance of the acquisition; or

Clearance contingent on divesting Wincanton’s grocery business, which represents 6 % of Wincanton revenue (< $100M). Grocery logistics is lower-margin (temperature-controlled distribution elevates costs), so a disposal would be margin-accretive.

Either outcome is favorable. Management also reaffirmed the targeted $58M in cost synergies, to be captured once integration begins later this year.

Customer resilience in an uncertain environment

Contrary to popular perception, enterprise customers entered 2025 well-prepared for trade turbulence. GXO’s client base is almost entirely large enterprises with dedicated supply-chain teams, so inventories were deliberately front-loaded ahead of potential disruptions. Front-loading does not inflate reported GXO revenue; the incremental volume-primarily from U.S. customers will ship out of warehouses in 2Q, 3Q, and the holiday season.

Management on the call stated: “Malcolm, if we look at inventory levels, North America is still elevated—especially in big-ticket tech. Those levels were already high heading into Q2 and remain so through May. Fashion inventories are also above normal, though less than tech. In short, there’s plenty of product in the system.”

Ex-US geographical presence paying dividends

GXO’s contractual, pure-play 3PL model is still widely misunderstood; the company is often lumped together with U.S.-listed logistics providers that are far more exposed to tariff-driven volume swings.

GXO generates ~75 % of revenue ex-US, with most of that coming from the EU and U.K., and it has zero direct China exposure—a key reason I expected a guidance hike this quarter. Management explained their caution: “We don't have any exposure to China, it's really kind of giving us a very strong confidence for the remainder of the 2025 year even against this very dynamic macro environment. In a normal environment, as a management team, definitely, we would have been raising our outlook for 2025.” Furthermore, if the current China tariffs stay elevated for longer, I view GXO as a beneficiary, as China-origin volumes get rerouted to the EU and EU enterprises turn to GXO. Management added: “If we see a softer U.S. economy and our customer-facing business in the U.S. declines by low- to mid-single digits in volumes, we still expect to remain within this tight EBITDA range.”

Repurchasing shares – In classic Brad Jacobs fashion, GXO bought back 2.8M shares at a weighted-average price of $39.66 under the $0.5B program authorized with 4Q24 results. I expected management to focus on leverage, but at ~3× net leverage and with the stock this cheap, the buyback is the right call.

1Q25 - The Negatives

Rising direct operating expenses as a % of revenue

Management called this a temporary Wincanton effect. Still, integrating Wincanton’s 80% open-book mix into GXO’s 50/50 open-book/hybrid closed-book model warrants attention: open-book contracts hold up well in volume downturns but run at roughly 7% EBITDA margins (vs 10% for hybrid closed-book). We should get deeper visibility once integration kicks off and GXO reports Q2. I’m only modestly concerned given GXO’s track record with larger deals like Clipper and an acquisition-savvy board. Near-term “gross” margin pressure from Wincanton’s higher direct-opex profile should be offset by synergy capture in SG&A and other operating expenses, areas where Wincanton already runs lean, so the overall synergy case remains intact.

Comments on churn

As noted in the prior update, GXO issued a conservative FY25 guide during 4Q24 earnings, mainly because several large-footprint customers were realigning volumes. There is typically a six-month lag before those warehouse slots are back-filled, and that timing is now feeding through the churn line. Management still expects 3–6% organic growth for FY25, built on +8% from wins, –5% churn, flat volume growth, and +1.5% from pricing. In other words, the “churn” here reflects temporary volume reshuffles—not lost contracts.

We are also hitting the five-year mark since the pandemic, meaning many contracts are coming up for renewal (standard term~ 5 years). Management emphasized that renewals usually occur before term expiry, pointing to two recent renewals with large North American customers despite tariff uncertainty. I suspect the churn figure is deliberately cautious, and GXO could outperform on organic growth if China-origin freight is diverted to the EU, lifting volumes. Still, any uptick in churn is something investors will watch closely.

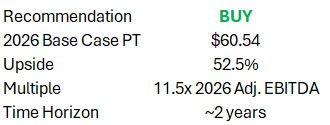

Updated Valuation & Modeling Assumptions (FY25–FY27)

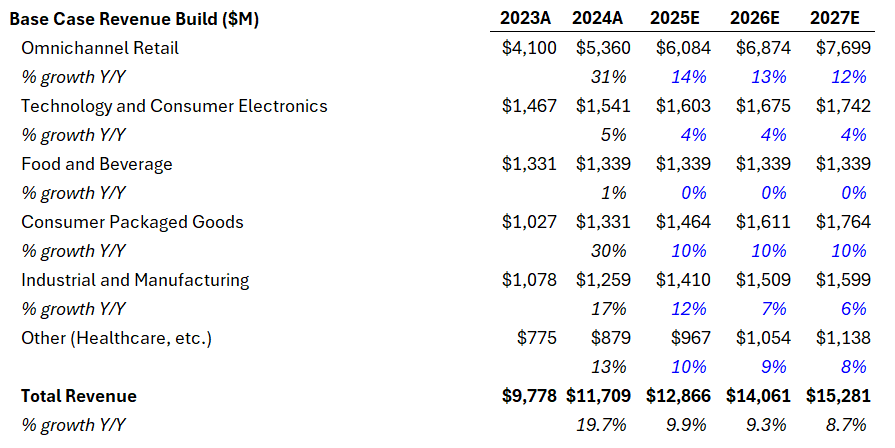

Not much has shifted, apart from a nudge higher on FY25 revenue after stronger‐than‐expected Wincanton growth and solid industrial & manufacturing momentum. I now model FY25E revenue at $12.87B, +9.9% Y/Y (previously assumed flat Wincanton growth during the “inorganic” period). Based on 1Q25 growth and a recovering U.K. consumer, I assume Wincanton grows 7.5% Y/Y for 01 Jan–29 Apr 2025, while core organic growth stays at +4.5%, in line with management’s conservatism.

For FY25–FY27, I project a 9.3% revenue CAGR, powered mainly by omnichannel retail, CPG, and newer verticals like healthcare.

On EBITDA, I expect $852.1M Adj. EBITDA in FY25, a touch above management’s $850M midpoint, driven by higher revenue and SG&A leverage once Wincanton integrates, partly offset by elevated direct opex early on. From FY25–FY27, I forecast a 14.4% EBITDA CAGR, with ~50 bps annual direct-opex savings (driven by automation, multi-tenant sites) and ~40–15 bps SG&A savings.

2026 Price Target

If my base case above is executed, I believe GXO is worth at least $60/share post-FY26 results (~2yrs from now). At $1B in adj. EBITDA by 2026, GXO should trade at least at an 11.5x multiple—conservative, ~0.4x below the current multiple. A few more quarters of displayed resilience should make the market sustain a multiple ≥11.5x while profitability grows. I anticipate cash generation to rise modestly as Wincanton is fully integrated within 1–2yrs, leases track historical trends, and management pays down debt at maturity. This yields an estimated ~$500M cash balance in 2026 and $5.48B in debt including leases. I also assume GXO repurchases 4% of the float annually, implying ~110M shares outstanding by FY26.

Risk/reward at current levels is attractive; management stays conservative on guidance, and the contractual business model provides clear visibility and resilience. Outsourcing, e-commerce, and moves into verticals like healthcare and industrial all serve as tailwinds. Nevertheless, in a bear case—if churn spikes at renewals or trade-war volatility dents the EU—I see GXO slipping to 10x adj. EBITDA on $826M of 2026E EBITDA, implying 26% downside to ~$29.38/sh.

Disclaimer: Nothing posted by P14 Capital should be considered financial advice. The author of this post holds a long position in GXO. Please consult a financial advisor and/or conduct your own due diligence before making investment decisions.