LONG $GXO - GXO Logistics, Inc.

A Leading Third-Party Logistics Provider Poised for Reaccelerating Growth

GXO Logistics, Inc.

NYSE: GXO | 12/20/2024

Key Thesis Points:

1. Reaccelerating organic revenue growth powered by record business wins.

2. Strong tailwinds benefit GXO as the pure-play 3PL market leader

3. Expanding EBITDA dollars and margins due to warehouse automation, multi-tenant warehousing, centralized cost-cutting, and synergistic acquisitions.

4. Q4 and Q1 outperformance likely, given reports of a strong holiday shopping season in key markets.

5. Possible "January Effect" candidate due to heavy end-of-year tax-loss selling.

6. The market misunderstands the “pass-through” nature of GXO’s business model

What brings this opportunity:

1. On 12/03/2024, GXO dropped 11% in after-hours trading after rejecting takeover offers and announcing CEO Malcolm Wilson’s retirement in 2025. This decline was exacerbated by year-end tax-loss selling and sector-wide non-fundamental-impacting news like FDX’s spinoff of its LTL freight business.

2. The broader logistics sector has been weighed down by uncertainty around the U.S. presidential election and potential tariffs, which is negatively impacting sentiment. However, GXO’s diversified global footprint and improving demand in key markets mitigate tariff concerns.

3. At current levels, GXO trades at 13.2x EV/LTM EBITDA, 5.4x EV/2023 EBITDAR, and 10.2x EV/2025E EBITDA which represents a discount relative to larger logistics players and an even more substantial discount relative to companies that secure revenues through long-term contracts.

Business and Industry Overview

GXO Logistics is the world's largest pure-play contract logistics provider, offering advanced warehousing and distribution solutions, including e-commerce logistics. Operating in 27 countries with ~130K employees, the company manages 974 facilities (613 leased, 2 owned, and 359 customer-owned), encompassing 199M square feet (113M sq ft leased, 1M sq ft owned, and 85M sq ft customer-owned). GXO’s services include high-value-add warehousing, order fulfillment, reverse logistics (returns management), and other supply chain solutions.

GXO became an independent company on August 2, 2021, through a spin-off from XPO Logistics. This strategic separation was designed to create focused entities, with GXO specializing in contract logistics and XPO concentrating on freight transportation. In November 2022, XPO further spun off RXO, a tech-enabled brokered transportation platform, resulting in three independent companies: XPO, GXO, and RXO.

Since its inception, GXO has pursued growth through strategic acquisitions. In May 2022, GXO acquired Clipper Logistics for $1.3B, significantly expanding its presence in Germany and Poland with over 50 sites, 10M sq ft of warehouse space, and 10,000 employees. In October 2023, GXO strengthened its North American operations by acquiring PFSweb, a tech-enabled eCommerce order fulfillment platform, for $181M. Most recently, in April 2024, GXO completed the £762M ($957M) acquisition of Wincanton, substantially increasing its market presence in the UK and Ireland.

In FY'23, GXO generated $9.8B in revenue and $741M in adjusted EBITDA with a margin of 7.6%. The company’s revenue base is highly diversified, with its top 5 customers contributing 17% of total revenue and no single customer accounting for more than 4%. Revenue is further diversified across verticals, with omnichannel retail as the largest contributor, and geographies, with the UK leading.

GXO boasts an attractive asset-light business model that serves 30% of the Fortune 100 (including major clients like Apple, Samsung, Zara, and Nestlé), featuring 15-year average relationships with top customers, overall customer retention of >95%, and long-term contracts (5-year average) aligned with warehouse leases for strong cash flow visibility. Capital expenditures are minimal, representing only 3% (1% maintenance, 2% growth) of TTM revenues.

GXO’s revenue model is primarily contractual, with both fixed and variable components. It offers open-book contracts (45% of revenue) and hybrid closed-book contracts (55% of revenue). For both contract types, GXO targets a minimum floor of 30% average return on invested capital. The minimum average contract size for a single-site (warehouse) customer is $20M in revenue per year and can exceed $40-$50M in revenue per year for multi-site customers. Contract sizes can vary significantly, not just based on the number of sites but also on various factors such as minimum volumes, product handling complexity, and value-added services (e.g., gift-wrapping, on-site product repairs, embroidery, product screening, etc.)

Open-Book Contracts follow a cost-plus structure, where GXO passes through all costs (fixed and variable) to customers with a fixed mark-up, resulting in stable ~7% EBITDA margins. These contracts require lower upfront investment and are resilient to volume fluctuations, as profitability is unaffected by macro changes. Margins are lower compared to hybrid contracts due to the lack of a variable cost savings component and lower depreciation expenses.

Hybrid Closed-Book Contracts combine fixed pricing for fixed costs (e.g., warehouse rent and automation) and a mark-up on fixed costs, with variable costs (e.g., labor and materials) borne by GXO but offset by variable revenue tied to customer activity. These contracts typically require higher upfront investment in technology and automation, leading to higher depreciation expenses. However, they achieve higher EBITDA margins (~10%) compared to open-book contracts, due to GXO’s ability to retain variable cost savings from efficiency gains enabled by automation. Inflation escalators are often included to pass through rising costs to customers. While requiring greater initial capital outlay, hybrid contracts provide EBITDA upside potential through cost optimization and operational efficiencies as volumes grow.

The contract logistics market in North America and Europe is highly fragmented, with the top players collectively controlling less than 25% of the total addressable market. On its 2023 Investor Day, GXO estimated that as of 2021, its Total Addressable Market (TAM) for outsourced logistics was $146B, with a broader warehousing TAM of $456B, including $310B of currently insourced logistics. Key competitors include DHL, CEVA Logistics (private), DSV A/S, and Kuehne + Nagel International AG. Notably, the total TAM of the warehousing market is expected to increase to $660B (6.4% CAGR) by 2027, of which $231B (8% CAGR) is expected to be outsourced. Based on an 8% CAGR, I estimate that the outsourced contract logistics market is valued at ~$170.3B as of 2023 year-end.

Despite its unique position as the only public, large-scale, pure-play contract logistics provider, the lack of comparable publicly traded pure-play peers leads the market to undervalue GXO’s business model superiority. Unlike broader industry competitors, which are more vulnerable to macroeconomic shocks and operate capital-intensive models with fleets, GXO benefits from an asset-light model that offers long-term contracts and extremely sticky revenues due to its deep integration into blue-chip customers’ supply chains. This inherent resilience and operational efficiency remain underappreciated by the market, as GXO trades at a discount multiple of 10.2x EV/2025E EBITDA, whereas larger logistics players and companies in adjacent industries that secure revenues through long-term contracts trade at higher multiples.

1. Reaccelerating organic revenue growth powered by record business wins

GXO experienced its first quarter of negative organic revenue growth in Q4'23, which management attributed to a weaker-than-expected 2023 holiday shopping season and customer-volume-related declines. During the Q4'23 earnings call, management expressed optimism that volumes would improve in the first half of 2024 and accelerate in Q4'24. So far, this narrative has held true. While GXO does not disclose specific volume metrics, management’s commentary about warehouse inventory levels and volumes has been optimistic, citing Q4'23 as the clear bottom for organic growth. This optimism was validated in Q3'24, as organic revenue growth reached 2.6%, marking the third consecutive quarter of accelerating growth.

GXO’s valuation has been constrained by a historical lack of organic growth, but positive commentary regarding growing volumes and management's strategy of supplementing growth with targeted, accretive M&A have supported the company’s outlook. The Wincanton acquisition, completed earlier this year, exemplifies this strategy, contributing to a total revenue growth of 27.8% in Q3'24. Wincanton’s annual turnover for the year ending March 31, 2024, was $1.786B, highlighting its significant potential revenue contribution to GXO. Management expects Wincanton to generate $1.1B in revenue for FY24, prior to integration beginning in FY25. The acquisition also establishes a platform for GXO to expand its aerospace and defense verticals across Europe, leveraging its existing market-leading position in aerospace and defense logistics in the U.S. Notably, as early as Q3'24, GXO signed a cornerstone deal with a leading U.S. aerospace provider for its European operations.

2024 is shaping up to be a record year for new business wins, with GXO securing $750M in new business year-to-date. These wins translate to contractual revenues realized over the current and subsequent 1-2 years. Of the $750M secured, $463M is scheduled for 2025, representing incremental revenue to GXO’s existing contractual base. The fixed consideration component of Remaining Performance Obligations (RPO) also highlights robust organic growth potential. As of the end of Q3'24, RPO grew 14.7% year-over-year to $3.9B, with the company expecting to recognize 77% of this amount over the next three years and the remainder thereafter.

GXO’s sales pipeline, consisting of prospective contracts, grew to a record $2.4B in Q3'24. Of this amount, GXO closed $750M in new business, equating to a 31% conversion rate—an improvement over its historical win rate of 25%. This demonstrates GXO’s continued ability to capture market share and solidify its leadership position in the contract logistics space. Additionally, over 40% of the $2.4 billion pipeline consists of customers outsourcing logistics for the first time. GXO is not only winning new customers but also actively taking market share from competitors, as 29% of YTD contract wins were from customers switching from other 3PL providers to GXO.

Management estimates a 10% organic revenue CAGR through 2027, which I believe is conservative. RPO from current contracts alone is set to contribute approximately $1B annually ($3.9B * 77% ÷ 3 years) until 2027, translating to an organic revenue CAGR of ~8%. It is unlikely that the combined effects of expanding existing client contracts, future new business wins across industries, and a continued inflection in customer volumes will bridge only a 2% gap between management’s projection and organic growth derived solely from current RPO.

My base-case assumes a conservative 11% total revenue CAGR from 2025 to 2027, resulting in $16.2B in total revenue by 2027, which is slightly above the top of management's 2027 revenue target range of $15.5B to $16.0B. I project 2025 to be the strongest year for revenue growth at +11.1% Y/Y, as 2023 and 2024's business wins translate into realized revenue in 2025, a normalized and improved customer volume environment materializes, and industry tailwinds continue to provide support.

From a vertical perspective, my base-case projections for 2025 to 2027 are as follows: Omnichannel Retail: 14.8% CAGR, driven by robust e-fulfillment demand. Technology and Consumer Electronics: 7.5% CAGR. Food and Beverage: 0.3% CAGR. Consumer Packaged Goods: 11.5% CAGR. Industrial and Manufacturing: 7% CAGR. Other Industries: 12% CAGR.

2. Strong industry tailwinds benefit GXO as the pure-play market leader

E-commerce: GXO is a clear beneficiary of the rapidly growing e-commerce industry and e-fulfillment. Notably, when a GXO customer transitions to e-commerce, the company experiences a 3x revenue uplift. During GXO’s 2023 investor day, CIO Manduca explained, “Unlike traditional brick-and-mortar, with e-commerce, each item needs to be sorted and separated, and individual packages need to be created to be shipped to the end consumer.”

Despite a slowdown in e-commerce sales over the past two years, global online retail sales are projected to grow from $4.4 trillion in 2023 to $6.8 trillion by 2028, representing an 8.9% CAGR, according to Forrester. Additionally, e-commerce is capturing an increasing share of total retail sales. In 2022, e-commerce represented 18.6% of global retail sales, rising to 19.4% in 2023, and is forecasted to surpass 20% in 2024, reaching 20.1%. By 2028, this figure is projected to grow to 22.9%.

This strong growth directly benefits GXO’s blue-chip customers and attracts new clients who increasingly rely on outsourced e-commerce logistics. GXO, as the market leader in e-fulfillment and 4-5x larger than other private pure-play 3PL providers, enjoys scale advantages that position it to win more e-fulfillment contracts. In Q3 2024, over 60% of GXO’s new sales wins were driven by e-commerce fulfillment. Management highlighted the uptick in e-fulfillment projects, citing the expansion of its partnership with Zalando (a leading European online platform for fashion and lifestyle) and the opening of the largest outsourced e-commerce warehouse in France, which is highly automated. GXO’s success in leveraging the e-commerce and e-fulfillment tailwinds is further evidenced by its growing omnichannel retail business and targeted, accretive acquisitions such as PFS (US e-fulfillment), Wincanton (UK 3PL), and Clipper Logistics (EU 3PL), which have significantly strengthened GXO’s position in the space.

Reverse Logistics: Within e-commerce and its ever-growing trajectory lies an emerging growth opportunity for GXO: reverse logistics. As e-commerce transactions continue to grow as a percentage of total retail sales, online consumers have become accustomed to free shipping and free returns. Increasingly, they are “test driving” products purchased online, leading to a higher volume of returns. The average retail return rate for e-commerce purchases is 26.4%, compared to just 10% for in-store purchases.

The business of processing returns is a lucrative one. GXO reports that reverse logistics generates a 2x revenue multiplier compared to ecommerce customers that only ship outbound parcels. With the ongoing acceleration of GXO’s e-commerce business, its returns business will naturally grow in parallel. Reverse logistics represented 7% of GXO’s revenues and is said to grow at a 14% CAGR through 2027. Moreover, the returns business is more profitable, with GXO noting that customers utilizing its reverse logistics services achieve significantly higher margins (~11% EBITDA margins compared to ~8%). It is important to note that returns tend to be the strongest in January, after the holiday season, as expanded in Thesis #4.

Outsourcing: As e-commerce grows, supply chains are becoming more complex, requiring faster delivery times and greater precision. The COVID-19 pandemic highlighted vulnerabilities in supply chains, accelerating the shift toward outsourcing. Companies now face a pivotal choice: invest heavily in advanced logistics technology or partner with providers like GXO, which offer the necessary scale, expertise, and infrastructure.

As of 2023, only ~30% of contract logistics was outsourced to third-party logistics providers (3PLs) like GXO. This outsourcing trend has evolved into a necessity, as businesses increasingly recognize the benefits of working with specialists—greater flexibility, reduced risk, enhanced innovation, and improved visibility into goods movement. GXO’s 2024 YTD results underscore this shift: 40% of new business wins were site expansions to support customer growth, while 31% came from customers outsourcing in-house logistics operations.

3. Expanding EBITDA margins due to automation in warehouses and synergistic acquisitions

Firstly, it is important to note that GXO is a misunderstood business. Although the company operates at <10% EBITDA margins, a large proportion of its direct operating expenses consists of fixed and variable costs (e.g., warehouse rent/lease, warehouse labor) that are largely passed through to customers as part of GXO’s contracts. Despite this nuance, investors often focus on what they see on the financial statements. It is true, however, that GXO must improve its EBITDA margins going forward. Management’s 2027 Adjusted EBITDA target of $1.25B-$1.30B implies a 15% Adj. EBITDA CAGR, and an 8% margin at the midpoint. The following are key levers for EBITDA margin and dollar growth:

Multi-tenant warehousing: GXO has placed significant emphasis on multi-tenant warehousing, as highlighted during the 3Q’24 earnings call. This model enables better utilization of underused warehouse space by integrating "anchor tenants" across GXO-leased facilities. Management has attributed sequential margin expansion in 2024 to improved space utilization. Building on this success, GXO is evaluating the possibility of consolidating leases set to expire into existing facilities under the multi-tenant model, which would further reduce costs. Although management has not quantified the impact, I estimate that the multi-tenant model contributed to a sequential EBITDA margin improvement of 15bps to 25bps in 3Q’24. From 2025-2027, my base case anticipates that multi-tenant warehousing will result in 20bps of annual cost savings in direct operating expenses.

The Wincanton Acquisition: Despite Brad Jacobs not being involved in GXO’s day-to-day operations, the company has continued to adhere to his philosophy of pursuing accretive acquisitions that strengthen new verticals. GXO has the successful Clipper playbook as a reference, a transaction that was instantly accretive and achieved synergies in two years, ahead of the three-year timeline initially laid out.

The Wincanton acquisition opens new revenue opportunities in the UK, particularly in industrial and aerospace verticals. It is immediately accretive to GXO, contributing $45M in EBITDA for FY24 before integration, which begins in FY25. Management expects the acquisition, prior to cost synergies, to add approximately $0.03 per share in 2024, with accretion increasing to double-digit percentages as integration progresses.

Wincanton was acquired at an attractive valuation of 7x 2024 EBITDA. Including synergies, management projects Wincanton to contribute $120M-$130M in cumulative EBITDA from 2025-2027. This guidance appears conservative, as Wincanton generated $139M in underlying EBITDA in their FY24 (ending March 31). For conservatism and considering the restructuring of Wincanton’s open-book contract structure to hybrid-closed book contracts to achieve higher EBITDA margins, my base case aligns with management’s guidance for Wincanton’s EBITDA contributions.

Automation: GXO’s competitive advantage lies in its leadership in automation and technology. While only ~10% of 3PL warehouses in the industry are automated, GXO’s automation rate stands at 42%, divided into 30% fixed (stationary robot arms, autonomous goods-to-persons systems) automation and 12% adaptive technology (e.g., collaborative robots, wearable vision tech).

Automation projects, with capex investments ranging from $10M-$50M, typically take 18 months to complete but deliver higher returns. Automated contracts provide customers with benefits such as improved inventory accuracy, up to 4x productivity increases, and cost reductions exceeding 50%. These contracts also have +200bps higher margins on average (e.g., 8% for non-automated vs. 10% for automated contracts). Management expects automation and productivity improvements to contribute $110M-$130M in cumulative EBITDA through 2027. My base case projects annual cost savings of 30bps in direct operating expenses from automation and adaptive technology from 2025-2027.

SG&A and Central Cost trimming: Management is focusing on improving central efficiency by reducing SG&A as a percentage of revenue and trimming central costs from direct operating expenses. My base case estimates these efforts will lead to 5bps of annual cost savings from 2025-2027. Notably, direct operating expenses as a % of revenue increased in the first three quarters of 2024 due to the Wincanton and PFS acquisitions.

Despite these positive drivers, GXO’s business model inherently has limited operating leverage due to its contractual structure, which involves passing through fixed and variable costs. My base case projects Adj. EBITDA to grow to $1.375B in 2027, exceeding management’s $1.25B-$1.30B guidance. The majority of EBITDA dollar growth is expected in 2025 and 2026 as cost savings, acquisition synergies, and core growth across verticals and in EU markets materialize. I anticipate EBITDA margins to expand to 8.5% by FY27, driven by the benefits of multi-tenant warehousing, increased automated contracts, acquisition synergies, and central efficiency initiatives.

4. Q4 and Q1 outperformance likely, given reports of a strong holiday shopping season in key markets

As stated earlier, Q4’23 marked the trough for organic growth, as GXO’s key markets experienced a weaker-than-expected holiday season and inventory shortages. On the organic revenue front, management projects 2-5% organic revenue growth at the midpoint of +3.5% organic growth for FY24, implying Q4 organic revenue of $2.797B, which represents a 7.6% Y/Y increase—an improvement from last year’s Q4, which saw a -2.3% Y/Y decline. I believe there is room for upside in Q4 organic revenue given reports of a strong 2024 holiday shopping season in key markets.

In the United States, MasterCard SpendingPulse reported a strong holiday shopping season, with total U.S. retail sales during the 2024 holiday season (November 1–December 24) increasing by 3.8% Y/Y. Online sales showed notable strength, growing 6.7% compared to 2023. Consumers increasingly preferred digital-first shopping, particularly in sectors like apparel, which saw a 6.7% growth in online sales. GXO’s expertise in e-fulfillment positions the company to capitalize on this trend. Promotional periods in November and the final five days before December 24 accounted for 10% of all holiday spending, highlighting demand spikes that only large-scale logistics players and 3PLs like GXO could manage. Strong online apparel growth could translate into a significant returns season starting in January (Returnuary). The National Retail Federation forecasts returns will amount to 17% of all U.S. merchandise sales, totaling $890B in returned goods—up from 15% in 2023. For 3PLs like GXO, who specialize in reverse logistics, Returnuary marks an extension of the busy holiday season.

In the United Kingdom, overall retail spend during the 2024 holiday season increased 2.3% Y/Y, compared to a 2% increase in 2023. Retail e-commerce spend outperformed, with e-commerce sales growing 6.1% Y/Y compared to 5.6% in 2023. E-commerce accounted for 41% of total holiday retail spend. On Black Friday alone, Brits spent £1.12B online, a 7.2% increase from £1.04B in 2023.

Across broader EU markets, e-commerce in Europe showed notable growth:

Germany: Online retail sales increased by 3.7%, contributing to a projected €87.1B in e-commerce revenue for 2024.

France: E-commerce sales grew by 4.0%, reflecting a steady rise in online spending.

Italy: The Italian e-commerce market saw a 3.6% increase in sales.

Netherlands: Online retail sales grew by 3.5%.

Spain: E-commerce sales rose by 3.8%.

Poland: Leading e-commerce platform Allegro reported a 10.8% increase in GMV to 14.7B zlotys in Q3 2024, with Q4 expected to see 11-13% GMV growth.

As evidenced by the data from key regions above, organic revenues in Q4 are projected to grow strongly. In my base case, I project GXO to report full-year 2024 organic revenue of $10.169B, implying organic growth of +4% Y/Y, exceeding the guidance midpoint and consensus of +3.5% Y/Y for the full-year 2024. As a result, I expect Q4’24 revenues to come in stronger at $2.846B, +9.5% Y/Y, on the back of strong performance in e-commerce in the omnichannel retail, CPG, and other verticals.

I project upside in total revenue as well, as the consensus is being conservative on the implied Wincanton Revenue in Q4. Based on consensus estimates for FY24 total revenues of $11.69B, Q4 implied total revenue is $3.23B, suggesting 24.7% Y/Y growth. Management previously stated that they expect Wincanton to contribute $1.1B in total revenue for eight months post-acquisition, implying 0% growth from Wincanton’s FY24 revenues. Wincanton alone has contributed $862M in total revenues YTD-Q3’24, which was generated in 154 days post-acquisition. This compares to ~$740.3M in the same period last year (154 days between Wincanton’s FQ1 and FQ2 ending 09/30/2023), reflecting a Y/Y growth rate of 16.4%.

By using the analyst consensus FY24 total revenue estimate of $11.69B and the consensus GXO organic revenue midpoint guidance of +3.5% Y/Y, the consensus estimate for total organic revenue for FY24 is projected at $10.12B, implying inorganic revenue of $1.57B. The implied inorganic revenue for Q4’24 is $520M, including revenues from PFSWeb (23 days) and Wincanton. Assuming PFSWeb generates $29M in Q4’24E inorganic revenues, this implies Wincanton will contribute $490M to Q4’24 revenues, representing an +8.2% Y/Y growth rate compared to ~$453M for their December 2023 quarter.

Given Wincanton's “strong double-digit revenue performance” (management commentary) post-acquisition and the stronger-than-2023 UK holiday shopping season, I expect Wincanton to outperform consensus estimates. I forecast Wincanton’s Q4’24 revenues will grow at a conservative +15% Y/Y, contributing ~$521M to Q4 revenues. (I say “conservative” because my projection estimates Q4 Wincanton Revenue to be lower than Q3’24 – which is unlikely for a business that experiences strong volumes in the holiday season.) This would result in Q4 total revenues growing +31.1% Y/Y to $3.397B, an upside surprise of 5.1% to consensus Q4’24E revenue estimates of $3.23B. Consequently, I expect FY24E total revenues to be $11.856B, implying a Y/Y total revenue growth rate of 21.2% and a +1.4% upside surprise to the consensus.

On the EBITDA front, management expects a significant step-up in Q4’24, at the midpoint guiding toward $256M (+32.6% Y/Y). This assumption appears reasonable, as GXO typically experiences a sequential improvement in nominal EBITDA from Q3 to Q4. The lapping of Q4’23 and margin improvements from better utilization of the multi-tenant network should support achieving this target. Due to projected revenue outperformance in Q4’24 hence FY24, I project Q4’24 Adjusted EBITDA to exceed the implied midpoint of $256M, reaching $262.3M (+35.9% Y/Y). This also reflects improvements in SG&A and modest savings from automated contracts that went live late in the quarter. As a result, in my base case I project GXO to report $826.3M in Adj. EBITDA for FY24, at the top end of management’s $805-$835M guidance and implying a 7% Adj. EBITDA margin.

Consensus estimates for Q1’25 total revenue are $3.042B, implying a Y/Y growth rate of 23.86%. A strong “returnuary” due to a solid e-commerce holiday season, which is expected, could result in a +2-5% revenue upside on consensus estimates. Consensus estimates for Q1’25 EBITDA are $184.93M, suggesting an EBITDA margin of 6.08%. Given the strong EBITDA profile of reverse logistics (11% EBITDA margin vs. 7-8% outbound), multi-tenant warehouse utilization, and central cost efficiencies, I believe there’s room for EBITDA margins to outperform consensus by 0.5% to 1%. Short-term outperformance would be even higher, excluding Wincanton’s drag on EBITDA margins since it operates predominantly under open-book contracts (80%).

5. Possible “January Effect” Candidate due to heavy tax loss selling

As noted earlier, there is no fundamental reason for GXO’s stock price to be in free fall. On the contrary, fundamentals are improving, with sequential organic revenue growth and adjusted EBITDA margin growth over the past three quarters, a growing sales pipeline, and a positive demand outlook for Q4’24 and FY25.

The January effect is the hypothesis that stock prices, particularly those of smaller companies, tend to rise more in January compared to other months. This phenomenon, attributed to tax-loss harvesting in December, is typically followed by reinvestment in January. While there is ongoing debate by academics on this hypothesis, I believe there is a source of short-term returns for companies improving their fundamentals, with an added emphasis on 'value stocks' like GXO that lagged the market in 2024.

While GXO’s market cap of ~$5B does not categorize it as a 'small company,' the stock trades well below its pre-acquisition rumor price of ~$50 and could very well trade at that level by the end of January 2025.

6. The market misunderstands the “pass-through nature” of GXO’s business model

At first glance, GXO may seem like a low-EBITDA-margin business, with margins below 10%. However, this perception overlooks the pass-through nature of GXO’s business model, where a significant portion of operating expenses is transferred to customers under both the fixed and variable cost components of its contracts.

The pass-through nature of GXO’s model extends beyond the Income Statement. GXO reports total debt as $2.779B, which consists of unsecured notes and term loans. Separately, GXO also records long-term operating lease liabilities of $2.067B and current operating lease liabilities of $681M on its balance sheet. Similar to other logistics companies, GXO does not include these operating leases in its total debt or net debt calculations. However, in GXO’s case specifically, the lease payments are passed on to customers as part of the fixed cost component in its customer contracts.

However, investors and the market often include operating leases as part of total debt when assessing logistics companies, given their capital-intensive nature. This practice leads to inflated EV multiples for GXO, as the market may not fully understand its unique business model and the absence of publicly traded pure-play peers with similar contractual revenue structures adds to this misunderstanding.

If operating leases are included as part of total debt, GXO’s total debt would rise to $5.527B from $2.779B, resulting in net debt of $4.979B compared to $2.231B excluding leases. This adjustment increases EV from $7.258B to $10.006B, significantly impacting valuation multiples, with the latter appearing inflated relative to the former.

The disparity between EV multiples is evident: EV/LTM EBITDA excluding operating leases is 9.6x, compared to 13.2x when including leases. For conservatism and alignment with the market’s perspective, I have included operating leases as part of total debt in my analysis.

To account for operating leases in valuation, EV/EBITDAR (which excludes operating lease expenses) is a more appropriate metric for comparing GXO to broader industry peers. However, unlike GXO, these peers are not pure play 3PL players. Their operating lease expenses are not pass-through to customers, as their revenues are primarily volume or rate-based (e.g., freight), rather than contractual. Even when operating leases are included in total debt and operating lease expenses are added back to EBITDA, GXO still trades at a discount to broader industry peers on a Last Fiscal Year EV/EBITDAR basis.

Risks

CMA Review of Wincanton Deal: The UK’s Competition and Markets Authority (CMA) is conducting a Phase 2 investigation into GXO's acquisition of Wincanton. The CMA raised concerns that the merger could reduce competition in the UK’s logistics market, particularly for large retail customers. The investigation’s deadline is set for April 30, 2025, and potential outcomes include:

Approval without conditions

Approval with remedies (e.g., divestments or behavioral commitments)

Prohibition if the merger is deemed too disruptive.

I assume the acquisition will be approved without conditions, similar to the approval of GXO’s Clipper acquisition.

Adverse macro conditions: While GXO’s diversified revenue base offers some insulation, adverse macroeconomic conditions remain a risk. Potential tariffs by the incoming U.S. administration could disrupt global trade, affecting logistics volumes. Additionally, inflationary pressures could dampen consumer spending, thus impacting customer volumes, particularly in GXO’s omnichannel retail and CPG verticals. However, GXO has inflation escalators in its contracts to pass costs onto customers, and its geo-diversification and long-term contracts offer resilience, as switching costs for clients are high. Despite these mitigations, tariffs, inflation, and global economic uncertainty are significant risks to monitor.

CEO Retirement and Succession Planning: Malcolm Wilson, CEO since August 2021, plans to retire in 2025 at age 67. While this is a natural transition given his age, the company will need to identify and integrate a new CEO capable of maintaining GXO’s strategic direction, presenting a risk to stability.

Base Case 2025 Target Price

Based on the outlined thesis and conservative estimates, I believe GXO is worth $66.73/share today, implying a +59% upside from current levels. This assumes no multiple expansion from the current EV/LTM EBITDA multiple of 13.2x. At present, GXO trades at a significant discount at 10.2x EV/2025E EBITDA.

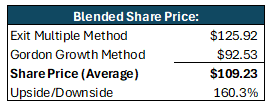

Base Case DCF Blended Share Price

In the execution of the 3-year DCF base case scenario, I believe GXO is worth $79.16/share today, implying an 88.7% upside from current levels. For the 2027 Exit Multiple Method, I have assumed no multiple expansion from current levels.

Bull Case 2025 Target Price

The 2025 Bull Case projects total revenues in 2024 to grow 22.9% Y/Y and 2025 total revenues to grow 12.9% Y/Y, driven by an increase in e-fulfillment projects and robust consumer demand across all verticals. Adjusted EBITDA in 2024 is projected to reach $893.4M (7.4% margin) and grow to $1.086B in 2025 (8.0% margin).

In this scenario, I believe multiple expansion is likely due to revenue and EBITDA outperformance, alongside a bullish update to management’s 2025 and 2027 financial targets. A strong Q4’24 and Q1’25 could prompt management to revise its guidance, especially as the company believes it is undervalued in public markets. This sentiment was evident in its exploration of a potential sale in October 2024 and the subsequent rejection of takeover offers in December 2024.

Recall management’s 2027 financial targets:

Revised in Q1’24 to $15.5B-$16B in total revenues and Adjusted EBITDA of $1.25B-$1.30B.

Originally, at its January 2023 Investor Day, GXO anticipated $17B in revenue and $1.6B in Adjusted EBITDA by 2027.

I believe GXO could warrant a premium multiple of 15x EV/EBITDA in a bull case scenario, reflecting the recurring nature of its revenues. A reversion to these initial estimates, supported by a normalized volume environment, would likely lead to multiple expansion, as investors recognize GXO’s business model superiority.

In a bull case scenario, I believe GXO could command a premium multiple of 15x EV/EBITDA, reflecting its recurring revenue base. For comparison:

Marriott: 22x EV/LTM EBITDA

Waste Management: 15x

Jacobs Solutions: 15x

Cintas: 28x

While these companies operate in different sectors, GXO’s projected 2025 outperformance and recurring revenue model could prompt investors to assign a premium valuation.

Bull Case DCF Blended Share Price

In the execution of the 3-year DCF bull case scenario, I believe GXO is worth $109.23/share today, implying a 160.3% upside from current levels. The bull case assumes total revenues to grow at a 12.7% CAGR from 2025-2027, with Adjusted EBITDA margins expanding from 7.4% in 2024 to 9% by 2027, resulting in $1.554B in Adjusted EBITDA by 2027. Supported by this financial outperformance, I anticipate the EV/EBITDA multiple to expand to 15x.

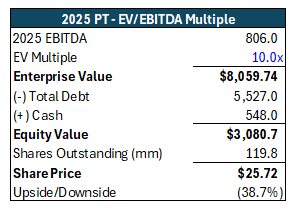

Bear Case 2025 Target Price

The 2025 Bear Case assumes total revenues in 2024 to grow 17.8% Y/Y (below consensus estimates) and 2025 total revenues to grow 8.3% Y/Y. Adjusted EBITDA in 2024 is projected at $761.5M, below management guidance, implying a 6.6% margin, and $806M in 2025, implying a 6.5% margin. In this scenario, I estimate GXO to trade at a 10x EV/EBITDA multiple, reflecting subdued growth and margin pressures.

Bear Case DCF Blended Share Price

In the execution of the 3-year DCF bear case scenario, I believe GXO is worth $30.14/share today, implying a 28.2% downside from current levels. The bear case assumes total revenues to grow at a 7.7% CAGR from 2025-2027, lower than the 8% CAGR expected from RPO, and Adjusted EBITDA margins to expand from 6.6% in 2024 to 7.3% by 2027, resulting in $1.055B in Adjusted EBITDA by 2027. Due to financial underperformance, I project the EV/EBITDA multiple to contract to 10x.

Summary Base/Bull/Bear cases

All 3 cases use an 8% discount rate and a 3% TGR.

Disclaimer: Nothing posted by P14 Capital should be considered financial advice. Please consult a financial advisor and/or conduct your own due diligence before making investment decisions.