GXO Logistics, Inc.

NYSE: GXO | 02/14/2025

GXO shares dropped 15% on 02/13/2025 despite Q4 results beating consensus, then rebounded 8.5% on 02/14/2025 as street analysts maintained price targets above current levels. The sell-off was triggered by disappointing FY25 guidance:

• Organic revenue growth of 3–6%

• Adjusted EBITDA of $840–$860M

• Adjusted EPS of $2.40–$2.60, well below the $3.09 consensus.

This tempered outlook raises concerns about GXO’s ability to meet its FY27 targets of 10% organic revenue CAGR, $15.5–$16 B in total revenue, $1.25–$1.3B in adjusted EBITDA, and a 15% CAGR in both adjusted EBITDA and diluted EPS. Although long-term targets were not formally revised during the Q4 call, CEO Malcolm Wilson hinted that a reassessment might be necessary following the leadership transition later this year.

FY24 Highlights

Total revenue grew 19.7% Y/Y, of which 3% was organic, to $11.7B, supported by strong growth in omnichannel retail (+30.7% Y/Y). GXO closed more than $1B of new business wins, of which 60% was e-commerce, and won a landmark $2.5B LTV contract in the health sector. The landmark deal came from the Clipper acquisition, showcasing the continued synergies mgmt. is reaping from acquisitions, and Germany is now the fastest growing market, with revenues growing 60% Y/Y in FY24. Market share continues to grow as 46% of FY24 contract wins were from sites transferred from other 3PL’s. Furthermore, $627M of FY24 business wins are signed as incremental FY25 revenue. Organic revenue % growth continued its sequential uptrend in FY24, closing the year with +3.9% Y/Y growth in Q4’24. Adjusted EBITDA met midpoint guidance of $815M in FY24, with a $45M Wincanton EBITDA contribution. FCF reduced to $251M from $302M in FY23 due to $70M in transaction and integration costs in FY24.

Drivers Behind the Tepid FY25 Guidance:

First, it’s important to note that GXO’s management tends to under promise and over-deliver at least on short-term annual guidance. This is evident in the Annual Revenue and EPS surprises relative to consensus estimates below:

The weak guidance on both the top and bottom lines is driven by multiple factors—most of which are one-off rather than structural weaknesses in the business model. The weak organic revenue guidance is primarily due to temporary disruptions from three large customers undergoing network realignments because of lower customer volumes, which has shifted activity from high-volume to lower-volume GXO sites:

• One major customer exited a large mature site, but GXO continues to win new business from them, with four new sites set to launch throughout 2025.

• Another automated site customer adjusted capacity; however, GXO retained the lease and has already secured a new customer that will contribute to profits in the second half of 2025.

• Additionally, a long-standing customer realigned its network due to lower consumer volumes but remains engaged with GXO.

These factors, along with FX headwinds of approximately $20M, are weighing on FY25 revenue. Note that network realignment is a short-term impact and does not mean lost customers—GXO experienced a similar situation in 2022 that was resolved later in the year.

All of these short-term issues result in low-single digit organic revenue growth in Q1, which translates into weak Adj. EBITDA guidance of $155M in Q1’25 versus $154M in Q1’24. As noted, new contract start-ups in mature sites take 6 months to contribute to profitability and about 12 months to reach full run-rate revenue.

Looking ahead to the FY25 Adj. EBITDA guidance of $850M at the midpoint:

• Mgmt. expects Q1 to be a -$15M detractor.

• Q2–Q4 are expected to deliver core growth of $25–$30M.

• Wincanton (including synergies) is expected to contribute $35–$45M versus the previously expected $55M for the FY, due to the unexpected timing of integration and additional transaction costs once the CMA review is complete (mgmt. expects to hear good news this week).

• FX and non-cash pension income are expected to have a -$15–$20M impact.

The most disappointing piece of guidance is the adjusted EPS, at $2.40–$2.60 compared to a $3.09 consensus. Lower projected revenues, a hit to Adj. EBITDA, and additional transaction and integration costs in FY25 are affecting EPS. However, the significant detractor to EPS is the effective tax rate. In FY24, the effective tax rate was 5.5% due to beneficial valuation allowances, and mgmt. now expects the rate to normalize to 25% in FY25.

FY25E Total Revenue Growth:

I believe mgmt. is being overly conservative on organic revenue guidance of +3–6% (midpoint +4.5% Y/Y). Incremental revenue of $627M signed for FY25 from FY24 business wins alone should lead to organic growth of +5.35%, assuming flattish customer volumes. For conservatism, let’s assume a base case of +4.5% organic growth. Recall that Wincanton was acquired in Q2 '24 (04/29/2024), so 01/01/2025–04/29/25 Wincanton revenues are considered inorganic. In the corresponding period in FY24, Wincanton generated an estimated $605M. Based on mgmt.'s commentary that Wincanton’s business is “trading well” and has grown double-digits top line in each of the past quarters since acquisition, let’s assume Wincanton inorganic revenue stays flat (0% Y/Y) for 01/01/2025–04/29/25, resulting in inorganic revenue of $605M. Adding this to organic revenue of $12.2B and factoring in -$20M FX brings total revenue to $12.8B, or +9.5% Y/Y.

Catalysts for a short-term rebound:

• Quarterly earnings beats: As noted earlier, mgmt. has a strong track record of setting conservative guidance and beating consensus estimates, and the FY25 guide sets them up well to do so.

• Insider purchases: The last insider buy was on 06/11/2024 at $49.95/share by the current CEO—well above today’s levels. (Note: A share repurchase plan in FY25 is unlikely as mgmt. focuses on deleveraging.)

• Affirmation of 2027 targets: Although maintaining 2027 targets seems unlikely given the one-off impacts in FY25, an affirmation from the new CEO could boost investor confidence.

Risks:

• Tariffs Exposure: Although management expects minimal impact due to GXO’s domestic focus, a significant increase in product prices would dampen customer volumes.

• Rising Direct Operating Expenses: Since the Wincanton Acquisition, this line item has gradually increased as a % of total revenues. I project 84.20% in FY25 up from 84.15% in FY24, reflecting delayed Wincanton synergies and start-up costs associated with network realignments. The effect of Wincanton integration on these costs remains a key variable.

• CMA review risk: An unfavorable outcome on the Wincanton CMA review will disrupt growth prospects in new verticals and the UK.

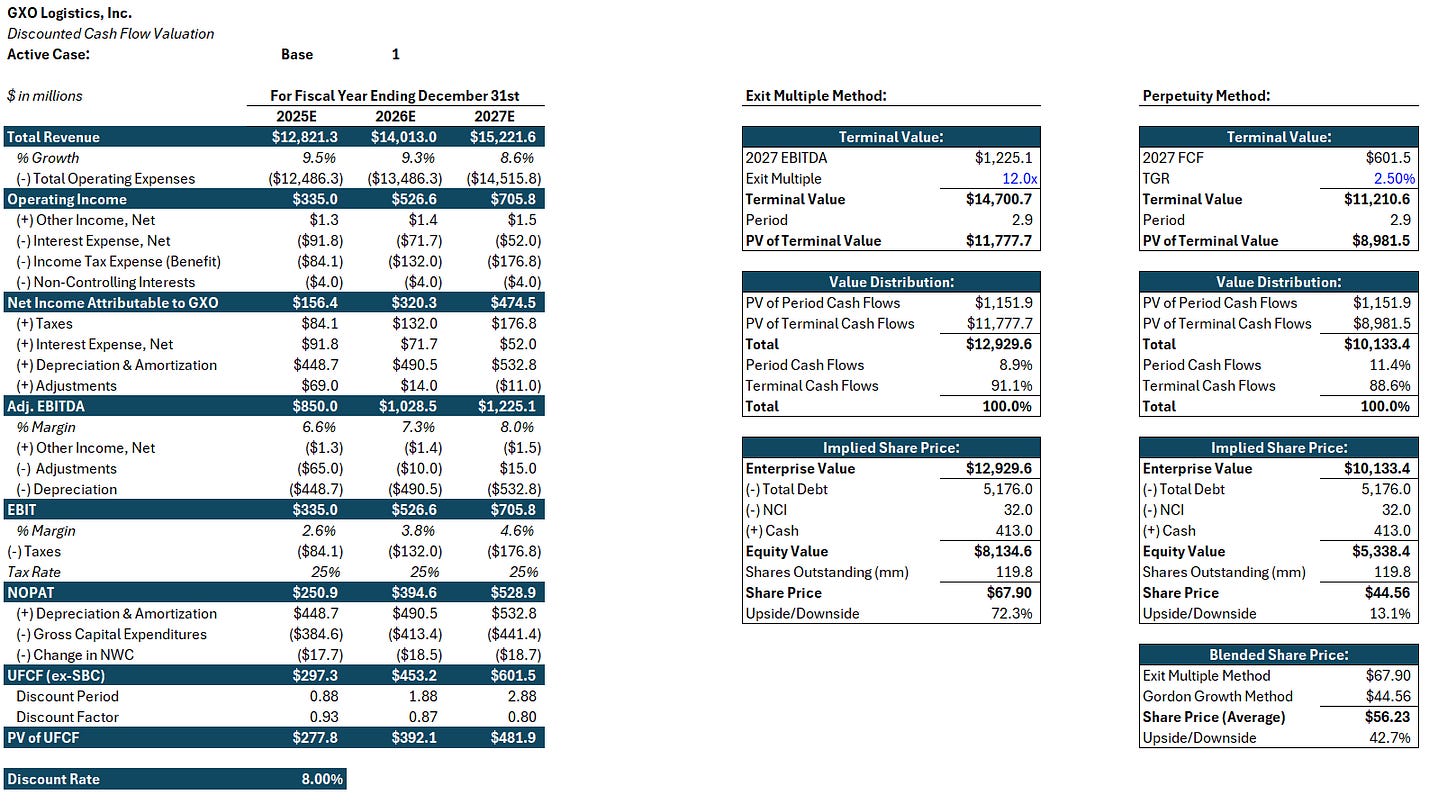

Updated Valuation & Modeling Assumptions (FY25–FY27):

Modeling Assumptions:

Terminal Growth Rate: 2.5%, revised down from 3%

Exit Multiple: 12x FY27 EBITDA (significantly lower than the prior 3Qs’ average of 14.3x EV/TTM EBITDA), revised down from 13.2x

Discount Rate: 8% (aligned with WACC)

FY24 Capital Structure: Total Debt of $5.176B (including leases), Cash of $413M, NCI of $32M, and 119.798M diluted shares outstanding

FY25–FY27 Core Assumptions:

Revenue CAGR: 9.1% (revised down from 11%), with growth tapering from 9.5% in FY25 to 8.6% in FY27

CAGR By Vertical:

Omnichannel Retail: 12.8%

Tech & Consumer Electronics: 4.5%

F&B: 0%

CPG: 9.8%

Industrial & Manufacturing: 6.7%

Other Verticals: 8.8%

Direct Operating Expenses: 84.20% (vs 83.6%) of total revenue in FY25 (up slightly from 84.15% in FY24) due to delayed Wincanton synergies and network realignment start-up costs; expected to decline by 50bps in FY26 and FY27 (30bps from multi-tenant warehousing and 20bps from automation)

SG&A: Flat in FY25 compared to FY24, then declining by 20bps thereafter

Adjusted EBITDA:

FY25: $850M (6.6% margin)

FY26: $1.028B (7.3% margin)

FY27: $1.225B (8% margin)

Tax Rate: 25%, vs 21% prior

Gross Capex: 3% of total revenue in FY25, declining by 5bps thereafter

Change in Net Working Capital: Assumed negative for conservatism

Comps

On an EV/EBITDAR basis, GXO continues to trade at a substantial discount relative to the broader logistics industry and close comps (bold).

Disclaimer: Nothing posted by P14 Capital should be considered financial advice. Please consult a financial advisor and/or conduct your own due diligence before making investment decisions.

I think the leverage part of the equation is about to change in a significant way. Historically, warehousing cost of a retailer can be 3-8% of sales, and a poorly managed warehouse that cost 7% of sales is not that big of a deal compared to a well managed warehouse that costs 4% of sales (and thus the warehousing industry remains majority insourced).

The delta is about to shift in a major way, giving significant leverage to GXO and GXO only. Automation + multi-tenant (added benefit of early onboard for smaller customers) + value-add services (reverse logistics) + scale (organic & inorganic growth) will drive GXO's warehousing cost to perhaps 2-3% of sales from the POV of a retailer. While inflation, lack of suitable workforce, and increasingly complex logistics & supply chain may push non-GXO warehousing solution cost to 10%+ for retailers.

I don't see why GXO can't grow topline at 15% and bottomline at 20-25% for the next 30 years.