LONG $EEFT - 3Q25 ER Update

Resilient results in a market that isn’t listening

Before we dive in to today’s FREE update, a polite reminder that P14 has just launched its paid offering. At just $19.99/month or $219.99/year (best value), you get:

1–2 long/short global micro/SMID-cap pitches each month, built on a clear thesis and modeled assumptions, with extensive earnings and event coverage.

Access to the paid subscriber chat, where we as a community discuss short-term trade ideas and P14 portfolio moves. Trade highlights so far include 100%+ on CPER Calls.

Curated equity screens, delivered at least bi-weekly.

Occasional industry primers and macro musings.

Some of my recent paid work:

Let me know what you’d like to see on the next screen (coming weekend) in the comments, or vote on the poll on two themes I’m interested in.

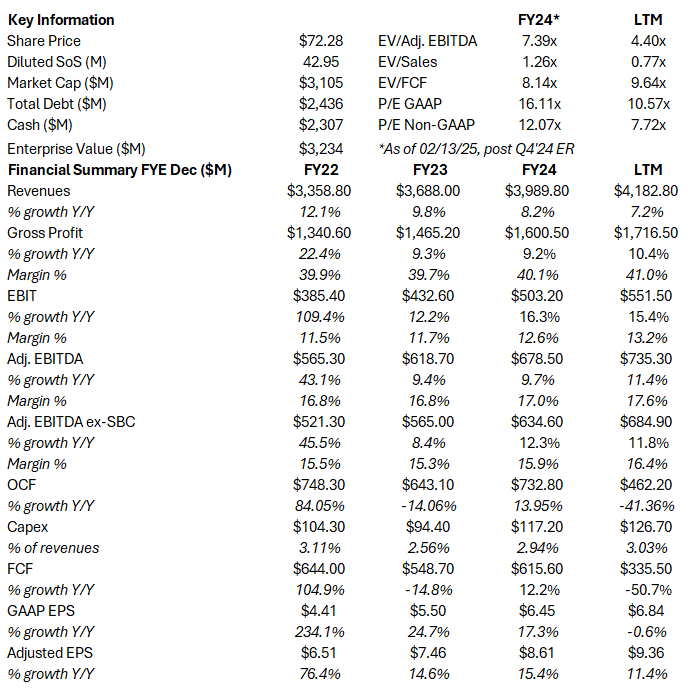

Euronet Worldwide, Inc.

NASDAQGS: EEFT | 11/07/2025

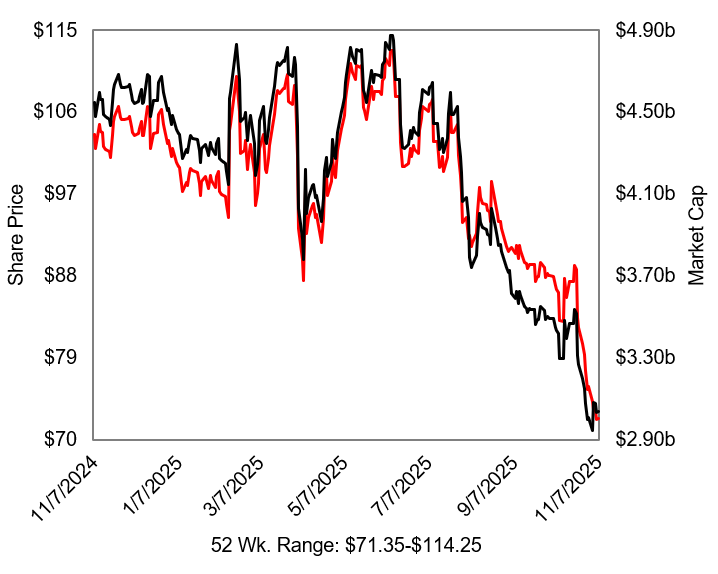

It’s been painful being an EEFT shareholder this year. In the last update, I said:

"If a person is looking for love, they should hope and pray to find a partner that loves them as much as EEFT shares love the $90–$100 level."

Clearly, that isn’t the kind of love anyone should wish for because it would be short-lived. EEFT has since been decimated and sent to the pits of the $70s. There are two reasons for this. First, as addressed in the 2Q25 update, EEFT shares have become an indiscriminate target for short sellers, who short the stock and go long the stablecoin and crypto nonsense with the proceeds. Second, and the more prominent reason, was the 3Q25 earnings miss.

But is it really as bad as the market fears? Has the long-term P14 thesis changed? That’s what this update will address. First, recall that the P14 thesis is essentially fourfold:

Immigration/deportation fears are overstated. Money transfer corridors are more diversified than peers, and the digital remittance mix is growing rapidly.

EEFT is shifting its image to be seen as a fintech/digital player rather than a legacy money transfer/top-ups/ATM business; the former commands higher multiples and the market still misprices this.

Margin expansion and profitability tailwinds across segments: EFT benefits from interchange/surcharge and recurring software (REN); Money Transfer margins expand as digital scales.

Attractive R/R, with EEFT trading well below historical norms despite being a consistent EPS compounder and share cannibal.

EEFT shares have slid ~-18.5% since reporting 3Q25 earnings on 10/23:

Revenue: $1.15B (+4.2% Y/Y, +1% CC), missing consensus by $50M (–4.4%).

Non-GAAP EPS: $3.62 (+$0.28 beat).

Guide reaffirmed: 12–16% Y/Y Non-GAAP EPS growth.

At face value, one could take a look at this and say, “Oh, they’re meeting or beating EPS, so it must be fine.” Not in this momo-market. Bull markets care more about top-line growth, and the lack of a top-line guide just keeps investors scared and in the dark. Still, there’s a case for concern. So, in classic EEFT fashion, let’s first take a look at the negatives of the quarter (EEFT fashion because the stock is seemingly always in negative territory) and how my original thesis is holding up or faltering.

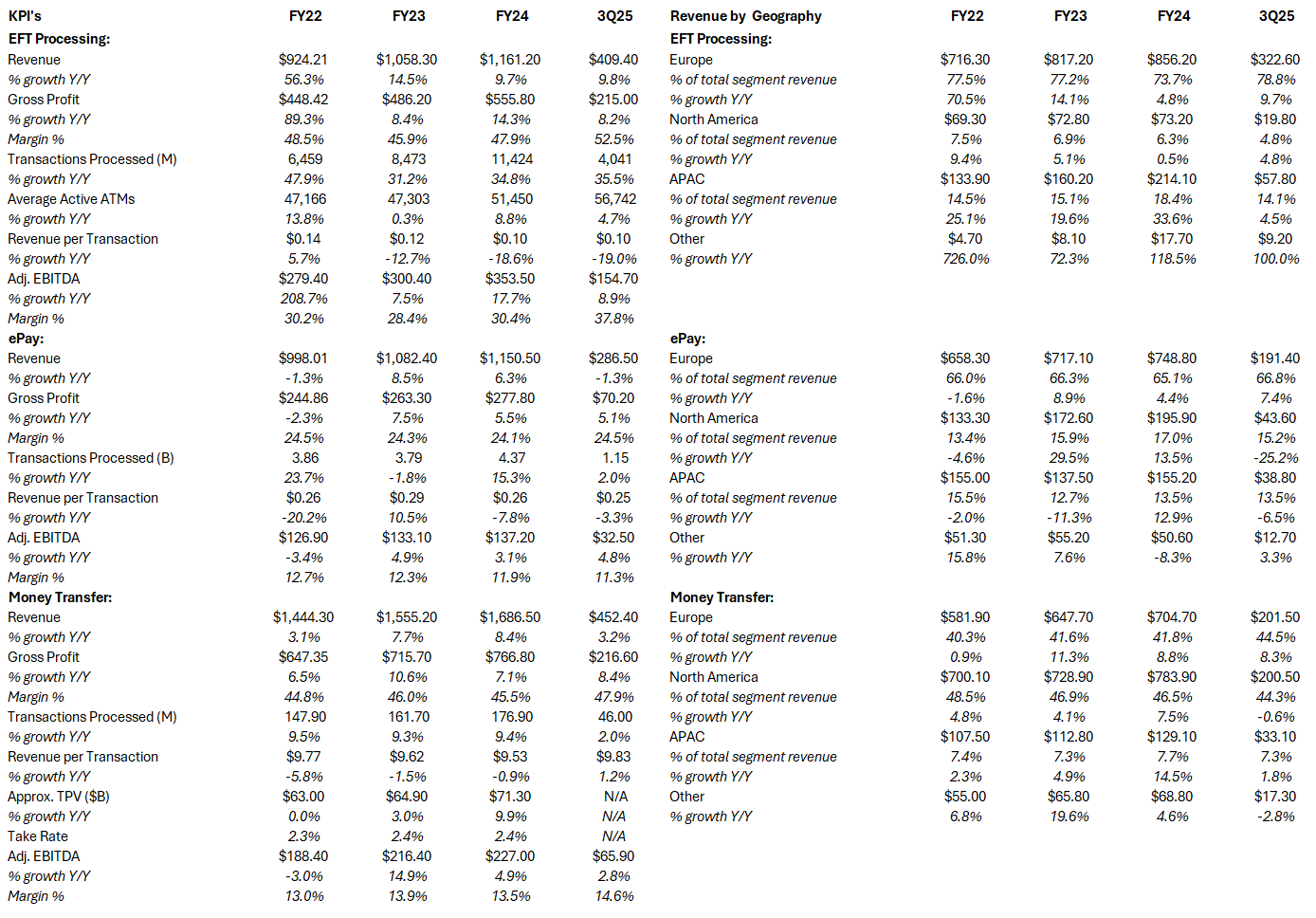

Negatives

Immigration fears were not overstated. In previous updates, I underestimated the effect that stricter immigration enforcement would have on the Money Transfer segment. The reality was tougher than expected, with Money Transfer revenue growing only 3% Y/Y (1% CC) and Adj. EBITDA declining 1% Y/Y. The U.S.–Mexico remittance corridor, which represents roughly 25% of EEFT’s total remittance volume and about 10% of total global transfers, saw industry-wide contraction of about –12% Y/Y, though EEFT’s own U.S.–Mexico transfers were flat Y/Y - a sign of relative resilience compared to peers but still not good enough for a seasonally strong quarter.

Total Money Transfer transactions grew just 2% Y/Y to 46M, and physical transactions, which still account for ~84% of total, declined –1.4% Y/Y. The weakness was concentrated in North America, where Money Transfer revenue fell –0.6% Y/Y, primarily reflecting physical immigration enforcement across the U.S. and a weaker low-income consumer. Inflation remains sticky at ~3% in the U.S. and elevated globally, so lower-income consumers are simply sending smaller amounts and doing so less frequently. Weakness also appeared in other corridors, including Germany and the U.K. into Bangladesh, Pakistan, and Turkey.

Management also noted minor pricing pressure, mainly limited to a handful of Middle Eastern corridors due to FX black market activity. Revenue per transaction still increased +1.2% Y/Y, but overall, money transfer was unusually pressured this past quarter.

ePay underperformed. Revenue declined –1.3% Y/Y (–5% CC), primarily because of the exit of a high-volume, low-value wholesale mobile top-up product that had contributed ~$15M in revenue. Excluding that exit, epay would have grown around 4% Y/Y, though still below its historical pace. Management attributed the shortfall to inflation and macro weakness, which together reduced discretionary spend by about 2–4 ppts.

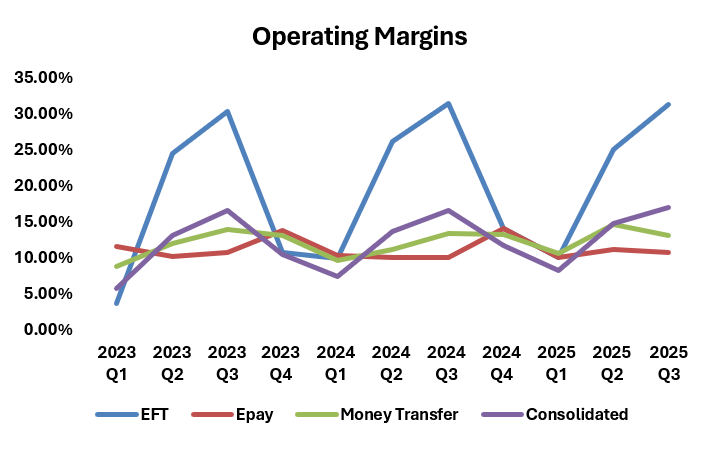

EFT came in softer than expected. Revenue increased +9.8% Y/Y (+5% CC) with transactions up +36% Y/Y, helped by continued travel recovery, but management flagged that consumers are being more cautious with their vacation budgets due to inflation affecting core travel expenses like flights and hotels. This resulted in lower ATM withdrawal amounts, pressuring ATM revenue. There was also minor softness in merchant acquiring and some timing delays in LatAm expansion due to sponsor bank issues, though neither were material. Gross margin declined 80 bps Y/Y to 52.5%, while operating margin fell 10 bps Y/Y to 31.4%, likely due to higher volumes of small-ticket transactions.

Still no investor day in sight. This remains a disappointment because the market/prospective shareholders would benefit from management articulating how the digital and software pieces - REN, Dandelion, and now CCRD - will look as a share of revenue in the next 3–5 years. If management wants to shed the “ATM company” label, then it only makes sense to back that up with a long-term framework and software revenue targets.

Capital allocation concerns? Mike (CEO) made a comment on how a better balance on capital allocation with share buybacks vs. M&A “might be 50-50.” A 50–50 split between buybacks and acquisitions is not the right approach at this valuation. All that matters right now is slamming the buyback button, which management has done effectively in the past, recently to offset dilution from the CCRD deal.

From a broad lens, many of these negatives are outside of management’s control. Add to this that fintech/payments as a sector is facing severe multiple compression, and money transfer names are in an even deeper hole because of negative sentiment around immigration.

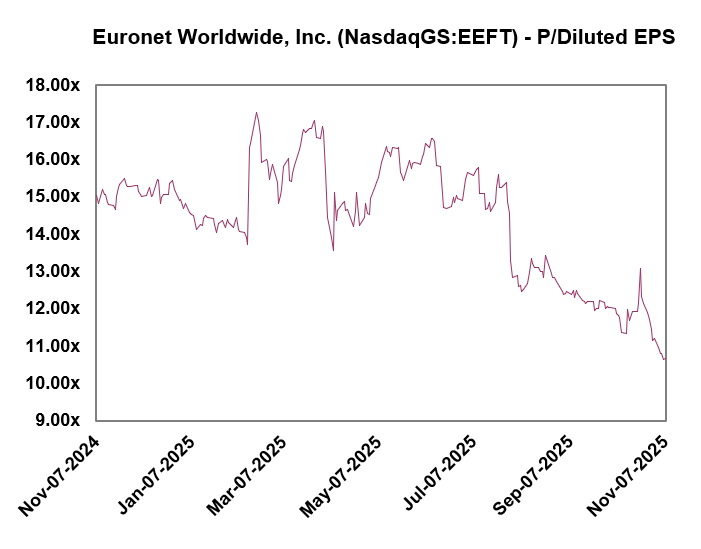

At a 10.6x LTM GAAP EPS multiple for a company growing EPS in the high-30s in the last 5 years (38.7%) and 13.5% over the last decade, many of us value investors involved with EEFT are starting to look like bag holders of a value trap. Still, I do not view the stock as a value trap - at least not yet - and that’s what makes the positives worth talking about.

Positives

Despite the negative market reaction, there were notable bright spots this past quarter and positive commentary about the near future.

Money Transfer trends improved in October. Management noted that October trends were significantly stronger than September and ahead of forecast. While we do not yet have official data on the U.S.–Mexico corridor, smaller ones are showing healthy momentum: Honduras reported US$10.1B YTD through Oct 31 (+26% Y/Y) and Bangladesh reported US$2.56B in October (+7% Y/Y). These are small contributors to EEFT’s total volumes, but they help validate management’s claim that conditions are stabilizing.

Management continues to view these headwinds as transitory, expecting both macro and immigration pressure to moderate over the next few quarters as developed economies like the U.S., Japan, and those in Europe continue to depend on migrant labor. In the P14 view, the U.S. headwinds are unlikely to vanish quickly since physical enforcement is likely to remain tight through FY26, but with midterms approaching in late 2026, enforcement could ease meaningfully late into next year.

Partnerships and wins. One of the more tangible positives came from new partnerships. The first was the Heritage Grocers win, adding 115 Hispanic-focused stores in the U.S. While competitors like WU and MoneyGram may still be present in some locations, Heritage appeared to be seeking a “smoother customer experience”, which suggests an eventual competitive displacement, which is where Ria comes in. In an optimistic case, if we assume ~30 transactions per day per store across 115 stores, that equates to ~1.26M annual transactions and an incremental $12.6M in fully-deployed run-rate revenue (at an avg transaction fee of $10), which would translate to a 0.7% bump to current LTM Money Transfer revenue.

The second win came through Dandelion, which continues to show meaningful traction. EEFT announced a major partnership with Citibank, using Dandelion’s API infrastructure to power wallet-to-wallet payments in the Philippines, Indonesia, Bangladesh, and Colombia. This broadens Citi’s cross-border capabilities across business-to-consumer and gig-economy flows. While difficult to model given the lack of potential transaction count detail, the strategic value is enormous, putting Dandelion on the map as a credible infrastructure layer for major financial institutions.

Beyond Citi, Dandelion is already live with Union Bank of the Philippines and will soon go live with Commonwealth Bank in Australia (largest bank in Australia). The network continues to build trust - the single most important factor in money movement - and that credibility will likely snowball as more institutions join.

EEFT also announced a strategic agreement with Fireblocks to integrate blockchain-based stablecoin infrastructure into its global payments ecosystem. This unlocks on- and off-ramp capabilities between digital assets and fiat, using Euronet’s ATM and wallet network. With the GENIUS Act now providing clear regulatory guidance, this move could allow real-world stablecoin use cases to scale safely within a regulated framework. The first pilot launches in 1Q26, focusing on treasury settlement, cross-border transfers, and consumer cash-outs. While I don’t get buy the thesis of stablecoins magically making remittances way cheaper than they already are, it’s good to see management making an attempt to shoo away the short remittance/long crypto traders in a cost-efficient manner (no silly M&A).

Digital growth continues. It feels good to see one of my thesis points reassured. Digital transactions in Money Transfer grew +32% Y/Y and now make up 16% of total transactions. Management continues to expect consistent 40%+ growth over time, which means digital should soon become a much larger contributor to overall mix. This growth helped offset weak physical volumes and supported stable margins in the segment.

Ria’s marketing advantage remains underappreciated. The presence of Ria signs across bodegas in immigrant neighborhoods effectively gives them low-cost customer acquisition that digital-only players can’t replicate. P14 believes continued physical enforcement in the U.S. will only accelerate the shift from in-person Ria to digital Ria remittances, given the “trust factor.”

Digital still represents only ~35% of the global remittance market after 2 decades, which highlights just how much runway remains. Management noted that around 13–14% of digital customers still toggle between physical and digital, further validating the omnichannel model.

ePay margin expansion. Operating margin expanded +80 bps Y/Y to 10.8%. The mix is now 70% digital content and 30% mobile top-up, and the business continues to add major partners like Giftzzy AU, Epic Games, Riot Games India, and Mercado Libre Mexico.

EFT and REN performance strong. Developing markets such as Morocco, Egypt, and the Philippines are producing outsized growth and higher profitability than Europe. Three new Polish merchant partners added deposit functionality, and EEFT signed an ATM outsourcing agreement with the largest bank in the Philippines. The merchant services business had its best quarter since acquisition in 2021, with operating income up +33% Y/Y and more than 7,000 new merchants onboarded in the Q.

While the market disrespects the ATM business, it continues to produce cash, with a new growth driver unveiled in the long-term EU ATM opportunity as banks increasingly outsource to EEFT due to branch closures creating “cash deserts.” For instance in Spain where a network doubled from 2,000 to 4,000 ATMs due to bank demand. Some non-profitable ATMs will be culled in the EU, but bank outsourcing and cash-access mandates are likely offsets.

REN again appears to be growing well, though management is doing a disservice by not breaking out revenue on earnings calls. Per the recent Northland conference call, REN is doing ~$55M of revenue with 65% operating margins, growing 40% Y/Y. The agreement with a top-three U.S. bank was mentioned again and a new deal with IDFC First Bank in India uses REN’s AWS architecture for debit, ATM, and transaction switching - the first of its kind in the country. Combined with CoreCard, EEFT now covers issuing, acquiring, and credit processing, giving it full-stack capability. The international opportunity for CCRD is enormous, as credit card issuance is strongly correlated with GDP per capita growth, a theme increasingly prevalent in Euronet’s wide geographic presence.

Consolidated margins show resilience. If there is one thing shareholders can count on from EEFT, it is resilient margin expansion. Despite weaker-than-expected top-line growth in the seasonally strongest 3Q, operating margins continued to expand, up 45 bps Y/Y to 17.02%.

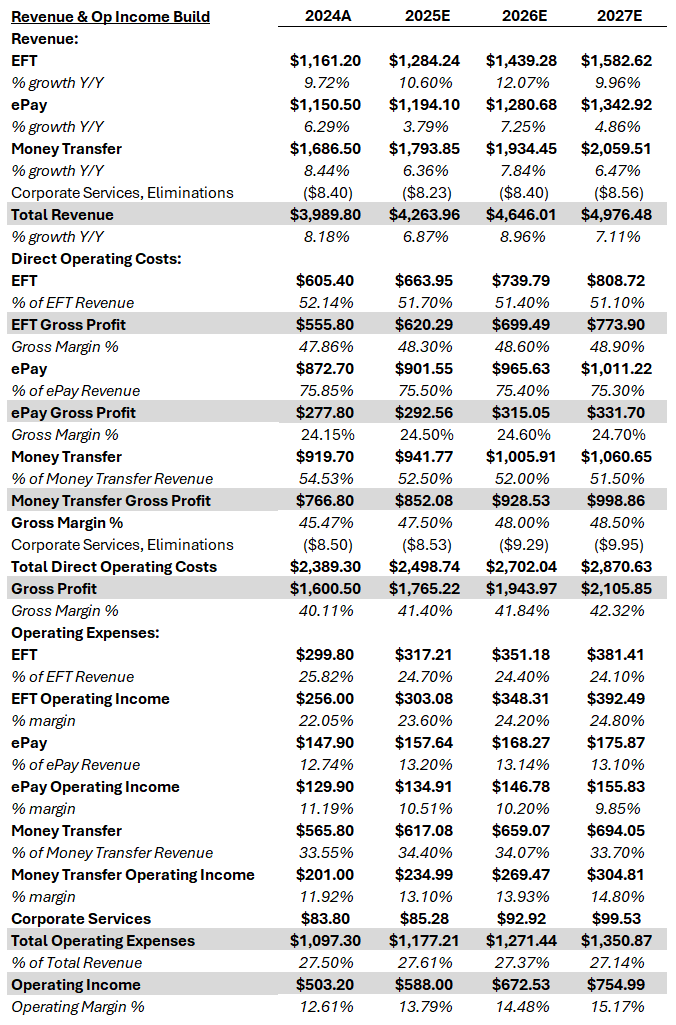

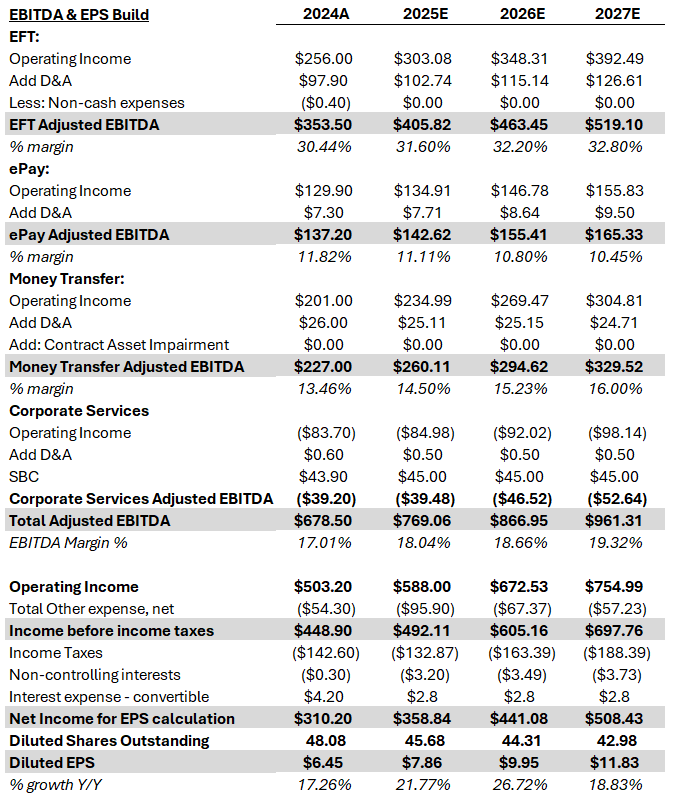

Updated top and bottom-line builds

At a 10.6x GAAP EPS multiple, the valuation keeps getting cheaper while earnings (and my pain of being an EEFT shareholder) continue to grow. Nevertheless, a reassuring feeling is that the 12–16% adjusted EPS growth guide remains well within reach.

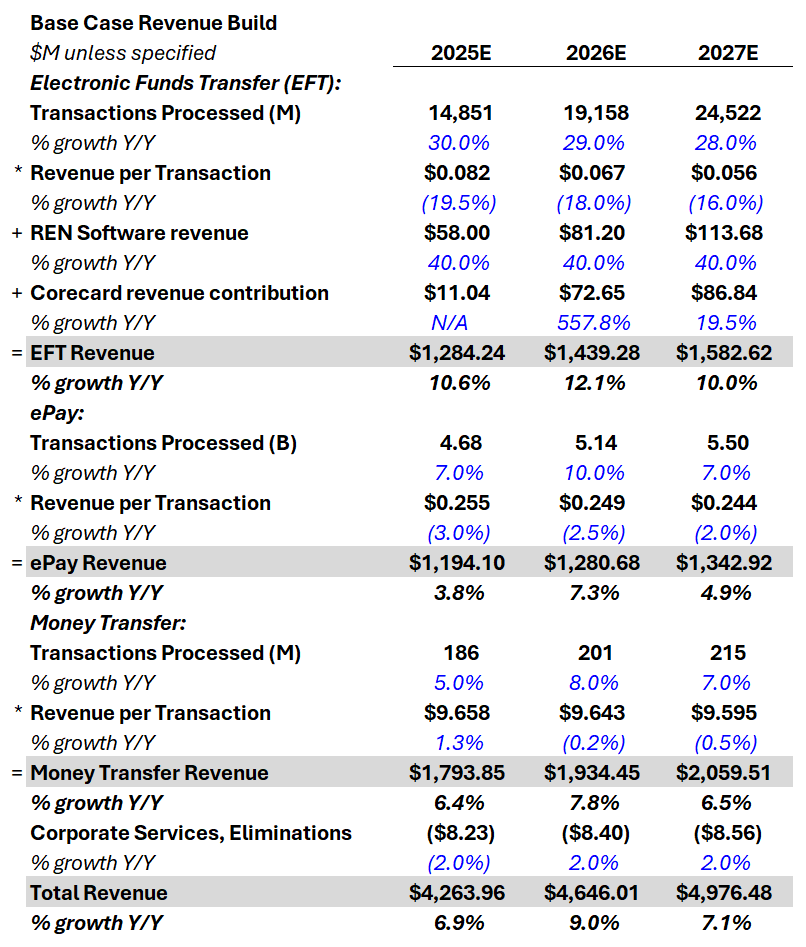

I have toned down FY25E revenue growth, expecting an acceleration in FY26 followed by a modest deceleration in FY27.

EFT: management continues to prune unprofitable EU ATMs, but “cash desert” policies are creating a natural offset. Travel remains healthy, though global inflation is trimming discretionary spend. Perhaps a speculative offset could come from the higher U.S. tax refunds expected in 2026 and the recently announced $2,000 tariff dividend (lol) could further support the 2026 travel season with higher discretionary spend budgets. Even with these potential offsets, I think the weakness from low-value transactions persists through FY25–FY27, as the ATM footprint expands deeper into lower-income countries where average ticket sizes are naturally smaller. I am not baking in any of the speculative refund or tariff catalysts discussed above. Nevertheless, cash is not disappearing in the next two years, and I continue to expect strong EFT transaction growth across the forecast period.

To now incorporate management’s recent disclosure on REN, I model $58M in REN revenue for FY25, ~$3M above the $55M figure cited in late September, with the delta coming from new deal wins expected to contribute incremental revenue this year. For FY26–FY27, I align with management’s commentary on 40% Y/Y growth for REN, though there is room for acceleration as they enter what is described as a “phase of accelerated adoption.”

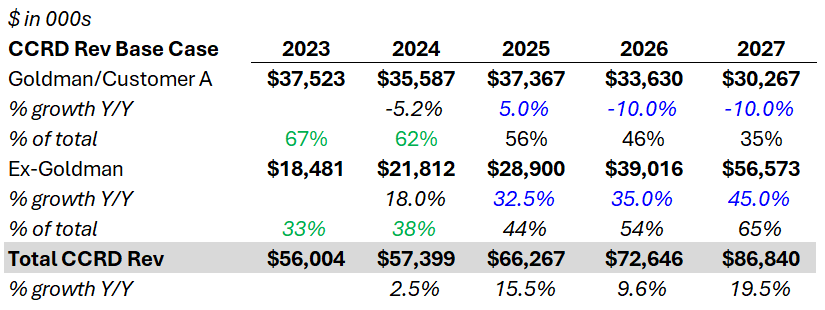

Since the CCRD acquisition closed at the end of October, it makes sense to include 2 months of FY25 contribution, equating to ~$11M in revenue assuming the business grows +15.5% Y/Y to $66.3M (within management’s $65–$69M FY25 guide). For CCRD’s contribution in FY26–FY27, it’s admittedly a tough call given the uncertainty around the Goldman relationship. The truth is that the Goldman contract runs until 2030, with termination rights after 2026 and compensation to CCRD if exercised. While JPM is reportedly circling to acquire Goldman’s Apple Card portfolio, a switch from CCRD’s platform to JPM’s in-house processor is not going to be immediate. It would likely take 2–3 years, given that Apple will demand absolute perfection for its user experience. There’s a reason CCRD was chosen in the first place: its technology supports first-of-month payments for all users, seamless Apple Cash integration, family-sharing controls, and installment plans tied into a single revolving balance. Re-platforming those under heavy oversight without breaking UX is far harder than people think.

To stay conservative, I assume a 10% annual decline in Goldman revenues in FY26–FY27, but ex-Goldman, the outlook is far more attractive. Excluding synergies from Euronet’s global reach, CCRD by itself should grow 30–40% ex-Goldman in FY26. I then model an acceleration in FY27 as the Euronet synergy effects begin to show up in revenue contribution.

ePay: To account for the softer macro backdrop and the portfolio exit, I now expect weak transaction growth in FY25. The combination of inflation, weaker discretionary spending, and the loss of a high-volume, low-value mobile top-up product means this year will likely remain sluggish. That said, I do expect a meaningful acceleration in FY26, driven by easier comps against a weak FY25 base and the impact of new partnerships that should help transaction counts recover.

Money Transfer: If we take management at their word that October trends were stronger and assume that the remainder of Q4 tracks at least in line with October or better than August and September, then a top-line surprise is plausible. Management also frequently referenced reciprocal tariff headwinds in emerging economies; if the tariff verdict currently before the Supreme Court were to be reversed, that could add long-term macro relief for some of these corridors. For now, I am not baking that into my forecast, but it remains an upside lever.

Now that Dandelion is scaling with new major FI partnerships and beginning to generate incremental transactions, it would help tremendously if management started breaking out those transaction counts separately. Based on my understanding, Dandelion functions essentially as a wholesale cross-border payment rails product that earns revenue via a small per-transaction fee + FX spread - likely in the 0.3–0.5% range on a wholesale basis. The recently announced Citibank partnership, spanning four countries, will probably contribute more meaningfully in 1–2 years once fully ramped - potentially adding >2M annual transactions on a run-rate basis -but those transactions will carry a far lower revenue per transaction than consumer remittances given their wholesale nature.

I project +6.4% Y/Y growth for FY25, reflecting weaker-than-expected transaction growth despite management’s optimism on October trends. It’s difficult to assume November and December will match that same pace.

On a consolidated money transfer basis, revenue per transaction is up +1.5% through the first 9 months of FY25, which likely reflects both higher average send amounts and modestly higher take rates. Given the world-class infrastructure EEFT already has in place, it can maintain take rates well below those of digital pure-plays like RELY, so I don’t see pricing pressure emerging as a real risk for at least the next 2–3 years. Looking ahead, I expect transaction growth to accelerate to +8% Y/Y in FY26 and +7% in FY27, up from ~+5% in FY25, driven by lapping effects, a gradually improving macro environment, contributions from Dandelion, and continued digital adoption. New in-person partnerships like Heritage Grocers will also add incremental support.

From a revenue-per-transaction perspective, I model -0.2% in FY26 and -0.5% in FY27, reflecting the shift in mix toward Dandelion and digital, which inherently carry lower revenue yields than in-person transactions. However, this will be partially offset by Euronet’s pricing power in digital channels.

Margins and bottom-line. Despite top-line underperformance, if there’s one thing EEFT consistently proves, it’s the leverage it holds on the bottom line. The majority of the original thesis still holds on margins. With the CCRD acquisition, EEFT should see small accretion to operating margins, and since REN is a software business running mid-60s margins, its growing share in the later years should further expand operating margins. The interchange and surcharge tailwinds are still very much alive, leaving room for additional upside to projected EFT operating margins.

I continue to expect epay to be the dog of the business, with some margin compression, while Money Transfer margin expansion should continue its steady climb. Given that Dandelion is a rails product with major investments already in place, its margins likely sit above 40–50%, meaning as it scales, the segment’s operating margins should expand even faster than projected.

Overall, in the P14 base case, I model Adj. EBITDA margins of ~18% in FY25E, ~18.7% in FY26E, and ~19.3% in FY27E.

I have revised my diluted share count to reflect the 2.3M new shares issued for the CCRD acquisition. I think it’s highly likely management buys back >1M shares in Q4 given the absurd valuation, and I’ve modeled 1.2M additional share repurchases. My GAAP EPS estimate for FY25 is maintained at $7.86/share (+21.8% Y/Y). I expect robust EPS growth of +27% in FY26 and +19% in FY27, supported by continued margin expansion and a ~3% annual reduction in share count in FY26 and FY27.

Updated Valuation and What Now?

EEFT now has many “growth call options” - REN, Dandelion, and now CCRD - yet management needs to explain the story more clearly. Quarterly guidance is difficult with three distinct businesses, but a 3-5 year revenue target is not. Like every serious operator, management likely has internal long-term goals anyway. An investor day is imperative at this stage to communicate the medium-term vision and give the Street a framework for how to model the business, so that quarterly misses do not continue to lead shares into the oblivion below us. Right now, in bull markets where value names are already tapped out, top-line misses are punished brutally, regardless of how the bottom-line looks. Combine that with the general apathy toward fintech and payments and the constant stablecoin FUD, and the situation becomes borderline disastrous if management continues letting the market stay in the dark.

The good news is that the Street is too bearish. In the P14 view, consensus FY26 revenue growth of +7.3% Y/Y is a tad low. The Street is underestimating the EFT ramp with CCRD and REN, as well as Money Transfer’s digital and Dandelion growth.

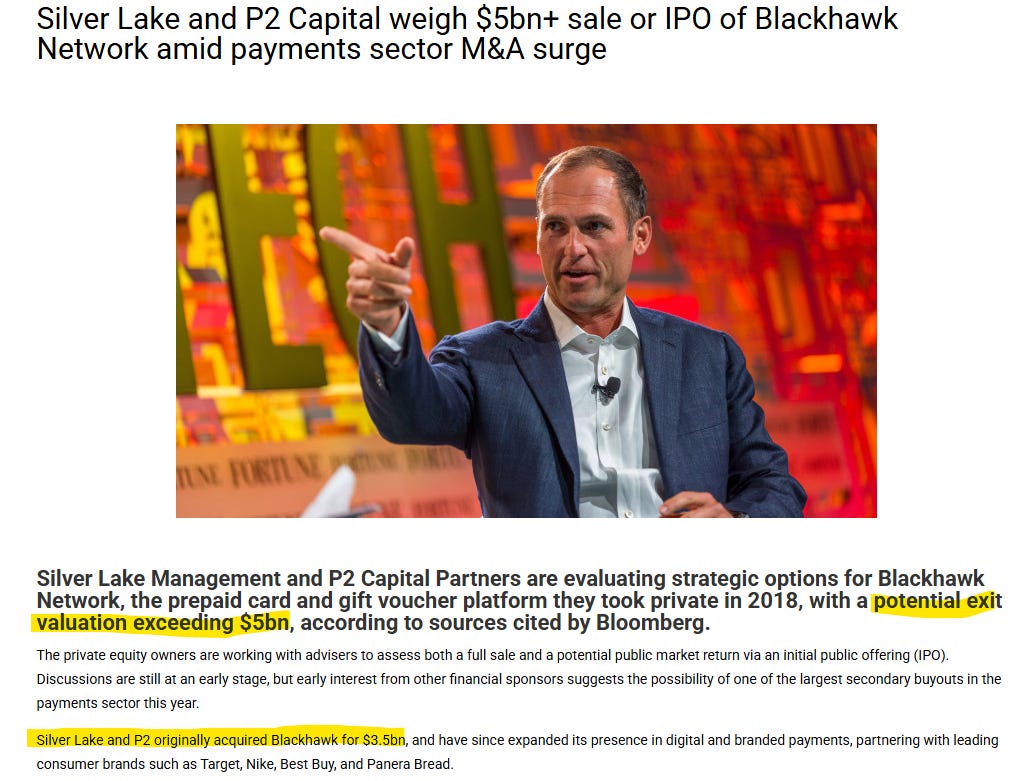

There has also been chatter online about suggestions in spinning off the ATM business. Personally, I think that would be a mistake. The ATM segment is a cash cow and will remain so for years to come. Cash is not going away, certainly not within the next 5–10 years. If a breakup ever came to the table, I would rather see epay spun off or sold to a strategic acquirer. It is the weakest link in terms of growth and margins and constantly needs promotional activity to spark revenue. More importantly, it fuels the outdated perception of EEFT as a “top-ups” business, even though roughly 70% of epay is now digital content with an increasing contribution from payment processing. There could be PE interest with similar precedents, such as when Blackhawk was acquired back in 2018.

Outside of a potential spinoff or an investor-day-driven rerating, an eventual rotation of capital back into fintech and payments, and earnings beats, there is only one clear catalyst that can help common shareholders right now - slamming the buyback button. History shows management knows how to use it effectively, and now is the time to double down.

At the current disdainful 10.6x GAAP EPS, for a company capable of growing GAAP EPS at least 15%+ for several years, EEFT remains glaringly undervalued. As Mike reminds us, “You can’t throw together a network that has 4B bank accounts connected to it, 3B wallet accounts, and over 600,000 locations to send or pick up money.” These assets are high-quality and practically impossible to replicate. Should the excessive discount persist, I would not be surprised to see a large PE firm swoop in and break apart the three businesses. There would be immediate returns from doing so, given how steeply shares trade below any reasonable sum-of-the-parts valuation.

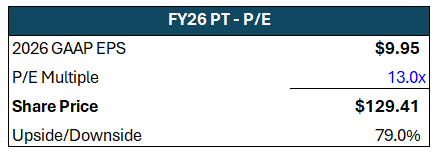

Base Case

If the P14 base case plays out through FY26, it is reasonable to expect EEFT to trade at 13x FY26 GAAP EPS, ~3x turns below where it traded after the Q4’24 release. This implies ~79% upside to ~$130/share within two years.

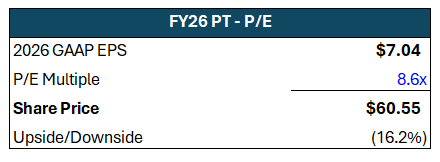

Bear Case

In the previous update, I mentioned that the stock already traded as if a bear case was playing out. Clearly, I was mistaken. In a bear scenario, EEFT would produce around $7 in FY26 EPS, implying only +9% growth vs FY24. If that happens, the current multiple could compress 2x turns lower, implying ~16% downside to ~$61/share.

Conclusion

To summarize, I still do not view EEFT as a value trap. The story simply needs to be told properly, with an emphasis on top-line growth, because in bullish markets like this, that is what investors care about most.

If valuation remains at these depressed levels, management should seriously consider a strategic review. The three segments would command higher valuations in private markets, and management would ultimately be serving their own pockets - and shareholders’ - by exploring such a move. Should this current valuation persist, I would not be surprised to see PE to start circling around.

I hope you enjoyed this free post. Please consider becoming a paid subscriber to access my higher-quality pitches, screens, and regular trade updates.

Best,

P14

Disclaimer: Nothing posted by P14 Capital should be considered financial advice. The author of this post holds a long position in EEFT. Please consult a financial advisor and/or conduct your own due diligence before making investment decisions.