LONG $CTLP - Thesis Update

2Q25 Earnings, Strategic Review, and the Recent Sell-Off

Cantaloupe, Inc.

NASDAQGS: CTLP | 03/13/2025

CTLP shares briefly flirted with my prior 2025 price target of $11.68—peaking at a 52‑week high of $11.36 on 02/25—before tumbling along with the broader market. I view this sell-off as a great opportunity, supported by near-term catalysts such as a potential sale. Even if no offers emerge or no takeover bids are accepted, this remains an opportunity to invest in a market leader still in the early innings of secular growth in self-serve commerce—driven by trends like cashless payments, international expansion, and micro‑markets (among others detailed in the main thesis). For background, please refer to:

The recent decline in CTLP, like many other stocks, is largely due to macro uncertainty and concerns over an economic slowdown. It is important to note that self‑serve retail (vending machines, micro‑markets, etc.) is relatively recession‑resistant given that consumers spend only a small portion of their budgets here (the average ticket size was $2.81 in 2Q25). Moreover, in an inflationary environment, CTLP benefits since 60% of its revenues are tied to inflation‑indexed transaction volumes—as seen in 2022 when transaction volumes grew +21% year‑over‑year.

Let's first review how 2Q25 earnings support the threefold thesis outlined in my original write-up.

1. Increasing micro-market adoption and expansion into high-ticket verticals leads to a reacceleration in subscription fees growth and continued growth in transaction fees.

The earnings call reinforced that increased micro‑market adoption and entry into high‑ticket verticals are reaccelerating subscription fee growth and driving continued transaction fee increases. The expectation was for subscription fees to rise as a result of high SEED software attach rates in micro‑markets and continued success in the Cantaloupe ONE program, along with growing transaction fees as average ticket sizes rise from a shift toward micro‑markets and high-ticket verticals.

Subscription fees grew +14.1% Y/Y in 2Q25, up from +11.51% Y/Y in 1Q25, with management noting that Premier Foodservice is replacing competitive micro‑market solutions and signing up for SEED across its network.

Expansion into new location types was also evident, with EBS Vending ordering several micro‑markets—including kiosks replacing full‑service restaurants—and several hundred Smart Stores sold across auto dealerships, colleges, and senior living facilities.

In high‑ticket verticals, management highlighted that the San Jose Earthquakes at PayPal Park added CTLP as their point‑of‑sale provider for all games and events (with full implementation expected in the 2025 season) and that the Entertainment Solutions Group secured a large number of pulse devices for amusement machines (note that average cashless arcade ticket sizes reach $6.13—750% higher than cash transactions)

These initiatives helped ARPU grow +11.15% Y/Y and contributed to a +17.15% Y/Y increase in transaction fees, supported by a +10.43% Y/Y increase in the average ticket size with take rates remaining steady at 5.27%.

All in all, there are no major changes to my base-case expectations for subscription and transaction fee revenue growth. I continue to expect transaction fees to grow +18.9% Y/Y in FY25, with a base-case CAGR of 18.48% from FY25 to FY28. Growth will primarily stem from higher average ticket sizes and sustained transaction take rates at 5.27%. Management reiterated that take rates are stabilizing at this level, so I no longer expect the 5bps improvement in FY26 that I previously assumed in the main thesis.

For subscription fees, I maintain my +15.5% Y/Y growth estimate for FY25, with growth weighted toward 2H25 (+18%), as sales of active devices (smart stores and micro-markets) in 1H25 drive SEED software revenue in 2H25. Additionally, a larger increase in micro-market and smart store equipment sales under the Cantaloupe ONE program should contribute to subscription revenue growth. My base-case subscription revenue CAGR from FY25 to FY28 remains at 16.3%.

Equipment revenues declined -7% Y/Y this quarter; however, the CFO clarified that equipment sales are expected to ramp significantly in 2H25, driven by larger smart store orders (pricing ranging from $12K–$15K per unit). With management reaffirming total revenue guidance and citing a strong 2H25 for equipment sales, I now anticipate total revenue to grow +17.5% Y/Y—up from my prior +16.9% estimate.

2. International expansion is overlooked, with significant revenue potential in untapped markets

The revenue potential in international markets, especially in LatAM where the market remains largely untapped, is still significant. CTLP continues to grow slowly in these markets, which is acceptable given management’s focus on quality execution over quantity. There appear to be challenges in finalizing a deployment partner in LatAM, as management alluded during the call: “While there was a slight adjustment in Latin America to ensure robust deployments and maximize transactions, the company is again in expansion mode.” Despite recent “nice wins” in micro‑markets in both Latin America and EMEA, the international revenue mix remains below 5%, with expectations for reacceleration in 2H25.

3. Incremental margins are underappreciated by the market

This thesis point highlighted the market’s underappreciation of incremental margins, as major contributions now come from improved transaction gross margins—improvements that the market deems unsustainable due to the perceived commoditized nature of the business and a lack of confidence in a reacceleration of subscription revenues. Mgmt. disproved both market perceptions with 2Q25 Adj. EBITDA coming in at $10.7M, +26% Y/Y, and reflecting a 14.5% margin versus 13% in 2Q24.

Mgmt. continues to execute with total GAAP gross margins in 2Q25 at 38.6%, +4% Y/Y, with contributions from:

Transaction gross margins of 25.6%, +4.5% Y/Y

Subscription gross margin of 78.8%, –1% Y/Y

Equipment Sales gross margin of 9.1%, +7.3% Y/Y

As highlighted in the main thesis, transaction margins continue to benefit from the growing average ticket size, operating leverage from the fixed fee component, and improved transaction routing and cost management.

2Q25 performance helps me reaffirm my base case estimates:

FY25 Transaction Margins of 25.07%, +4% Y/Y, with a steady +4% improvement thereafter until FY28—primarily driven by the increasing average ticket size

Subscription gross margins of 89.25%, +0.05% Y/Y, with incremental 0.05% improvements thereafter until FY28

Equipment Sales gross margins of 11.50%, +4.6% Y/Y, with an expected improvement to 13.50% by FY28

Equipment sales gross margins are expected to improve significantly due to the better margin profile of smart-store and micro-market equipment sales.

All of the base case revenue and cost assumptions driving EBITDA are summarized in the table below:

Additional Positives in 2Q25:

Active customers grew by 9.6% to 32,909, reflecting rapid adoption of micro‑markets and smart stores and success in other high‑ticket verticals like amusement and sports.

Active devices’ Y/Y growth accelerated QoQ to +3.5% in 2Q25, reaching 1.27M versus +3.2% in 1Q25.

The company reaffirmed its fiscal year 2025 guidance for total revenue ($308M–$322M), transaction and subscription revenue growth (15%–20%), GAAP net income ($22M–$32M), adjusted EBITDA ($44M–$52M), and total operating cash flow ($24M–$32M).

Launched Cantaloupe Capital in collaboration with Fundbox, aimed at helping SMB customers overcome capital constraints to expand their business and secure more devices and micro‑markets. Under this arrangement, Cantaloupe does not hold or underwrite the loans; it acts as a convenient gateway for customers, making it easier for SMBs to fund working capital and acquire new CTLP devices through Fundbox. In contrast, Cantaloupe ONE is aimed at customers using 100% of their solutions, while the micro‑lending product has a broader scope, helping customers fund working capital and new equipment beyond Cantaloupe's specific offerings.

Launched the Cantaloupe AdVantage program, which allows brands to engage with consumers through digital advertising on CTLP point‑of‑sale touchscreen devices. The first campaign with Mastercard delivered over one million impressions in the first 10 weeks. Revenue from this program is generated through per‑impression models in marketplaces and custom pricing for bespoke campaigns, with revenue sharing with customers.

Negatives in 2Q25:

Total operating expenses increased to $24.5 million compared to $20.7 million in Q2 FY2024, largely due to expenses incurred from recent acquisitions (CHEQ and SB Software). Operating margins still improved by +1.96% Y/Y to 8.36% in 2Q25.

Strategic Review and Valuation

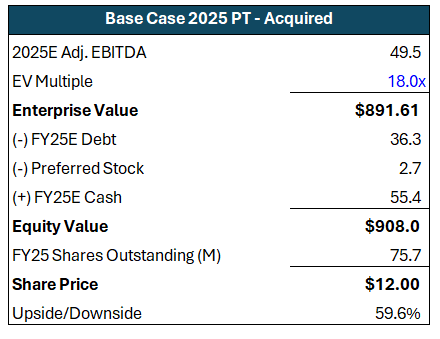

Reuters reported on 02/25/2025 that CTLP is working with JP Morgan on a potential sale or go-private transaction. This exploration makes sense, as growing profits and expanding margins are not reflected in its share price. Based on management’s midpoint FY25 guidance of $48M in adjusted EBITDA—with an expected 41% YoY growth by FY25 end and a 69% CAGR from FY22 to FY25—the company is currently valued at a meager 11.96x EV/FY25E adjusted EBITDA. I believe my base case FY25E adjusted EBITDA of $49.5M (3.12% above the midpoint) is likely to hold, implying a multiple of 11.59x EV/FY25E adjusted EBITDA.

Before diving into transaction comps, it is important to assess the likelihood of a takeover. CTLP operates in a very niche sector in payments—self‑service commerce—which is still in the early stages of growth. Precedent transactions (of which there is not much public data available) in this space consist of private equity investments in private companies—namely, NMI, a global full‑commerce enablement technology company that received a significant new equity investment from Insight Partners in October 2024, and Providence Equity Partners’ acquisition of a majority stake in 365 Retail Markets in December 2020.

Aside from private equity, CTLP could attract offers from POS/transaction and payments processing companies like NCR Voyix (VYX), Shift4 (FOUR), and others like GPN, as well as companies operating more on the tech side of self‑service commerce like Crane NXT. The likelihood of FOUR putting in an offer is low, as they recently acquired Global Blue. VYX may put an offer up, considering they are at risk of losing market share in the restaurant space—as PAR Technology (PAR) eats into their market—and given recent management and board changes, as well as the divestment of their digital banking business, though leverage may be an issue. CXT’s likelihood is low but not impossible, given that they are more focused on the software (detection, sensing, and security) side of self‑service commerce.

It seems increasingly likely that if an offer materializes, it will come from private equity. CTLP checks all the boxes—profitability, rapidly expanding margins, a healthy balance sheet, recurring cash flow, and accelerating top‑line growth—while operating in an industry with strong secular upside.

Average Payments M&A purchase multiples in 2024 were 18.6x, according to Fintech Investment Bank Capstone Partners. The transaction comps below, consisting of a blend of SaaS and payments companies, suggest an EV/EBITDA multiple of 16x–21x (median–mean). Do note that there are no public precedent transactions of companies that are truly similar to CTLP’s business model.

I originally thought that a 20x EV/EBITDA multiple would be fair for a business set to grow EBITDA by 46% this year and at a 37% CAGR from FY26 to FY28. However, with the stock tanking in classic small‑cap fashion for no fundamental reason, a 20x multiple now seems unlikely; hence, I have opted for an 18x multiple in a base‑case scenario, which suggests an upside of 59.6% from current levels.

An unsuccessful strategic review may dent the stock price in the short run; however, I do not believe this would affect the long‑term trajectory of a business run by what I consider to be a grade A management team. Ravi and the team have truly turned the ship around since the delisting and the USAT accounting shenanigans in 2019, setting the business up for profitable growth. In the event of no acquisition, I think CTLP could trade at a 16x multiple, which calculates to $10.69—suggesting an upside of 42.2% from current levels. Note that this multiple is lower than the 17.3x in the original thesis due to market volatility and an uncertain macro environment.

For long‑term investors, my base‑case blended intrinsic value—using CTLP’s 2Q25 capital structure, a 10% discount rate, a 16x EV/EBITDA exit multiple, and a 3% TGR, along with assumptions highlighted above and in the main thesis—calculates to $12.80, suggesting an upside of 70.2% from current levels.

Appendix

Disclaimer: Nothing posted by P14 Capital should be considered financial advice. Please consult a financial advisor and/or conduct your own due diligence before making investment decisions.

16x EBITDA valuation seems high. Global Blue was acquired for ~13x CY2024 Adjusted EBITDA and it has higher growth and margins. https://www.businesswire.com/news/home/20250226442203/en/Global-Blue-Reports-9M-FY2425-Financial-Results-With-Double-digit-Growth