P14 Weekly Screen #4 - Consumer Disc

The case for low-ticket consumer names + 5 stocks on the P14 watchlist

CHRISTMAS AND NEW YEAR FLASH SALE (expires 01/01/2026)

Greetings.

As tax-loss selling season heats up, it feels like the right time to look at one of this year’s major underperformers: consumer discretionary. For simplicity, given how broad the sector is, my focus here is on low-value discretionary products. I am not looking at Autos, household appliances, electronics, or other high-ticket categories. The core subset for this screen is apparel, low-value recreational goods, restaurants, and similar retail-tilted names.

Why consumer discretionary has underperformed in 2025

There are multiple drivers behind the underperformance in this sector, outside of idiosyncratic factors. The broad reasons that hit the group as a whole are:

Long AI and short consumer discretionary.

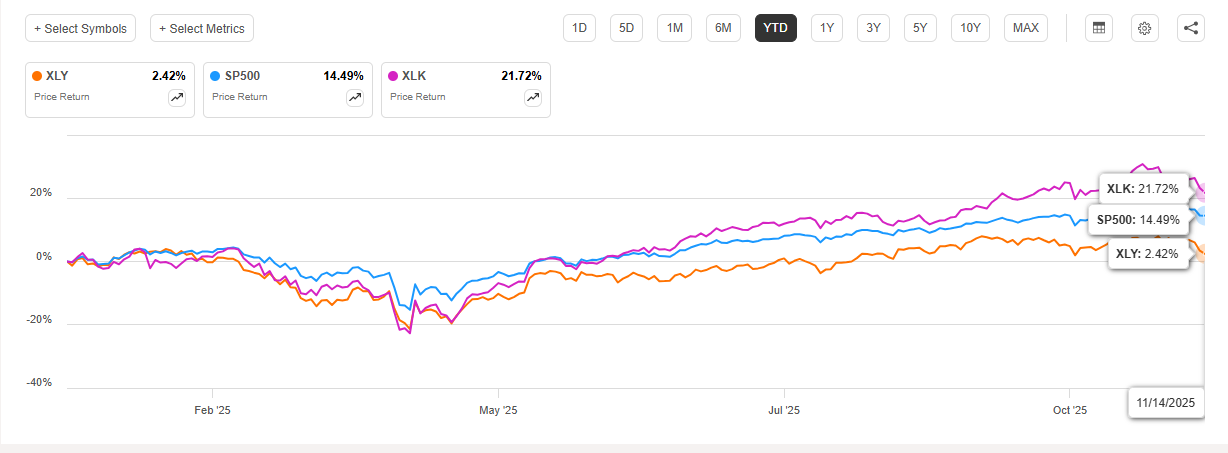

This has been the go-to pair trade run by pod and L/S shops this year. You can see it in the months of elevated short interest across individual discretionary names and in how crowded the AI trade has become. Momentum in AI-capex beneficiaries and even AI-adjacent nonsense like quantum computing has been relentless. Even looking at XLK vs XLY shows the divergence clearly, despite XLY including AI/tech-exposed giants like AMZN and TSLA.

A weak consumer at the lower end.

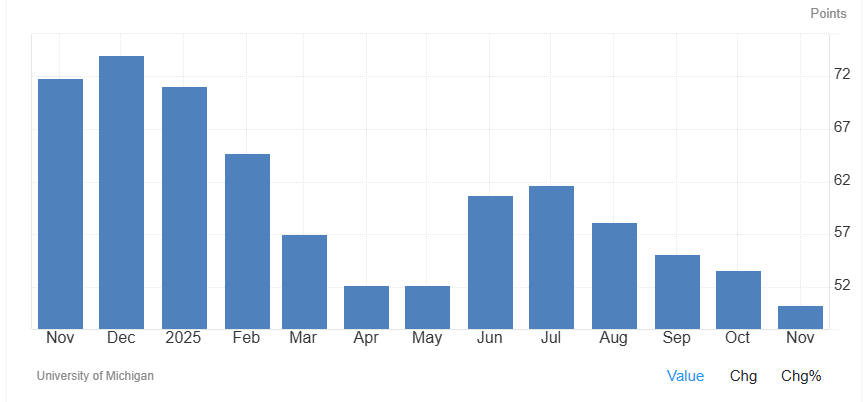

This economy has been held up by the rich consumer and the wealth effect (K-shaped economy). Rising financial asset prices have reinforced confidence at the top end, and that is where the marginal $ of spending growth is coming from. Lower-income households, who matter more for low-value discretionary names, have been weak all year. Persistent inflation, the end of stimulus-era cash, and higher rates have compressed budgets. Almost every management team in this space has mentioned a soft lower-income consumer in FY25 earnings calls. The weakness in consumers is further reflected in the University of Michigan’s Consumer Sentiment Index, which fell to 50.3 in November, below the levels seen in April when tariffs were initiated. This reading marked the second-lowest on record, driven by heightened economic uncertainty during the government shutdown, which has since been resolved.

The T word.

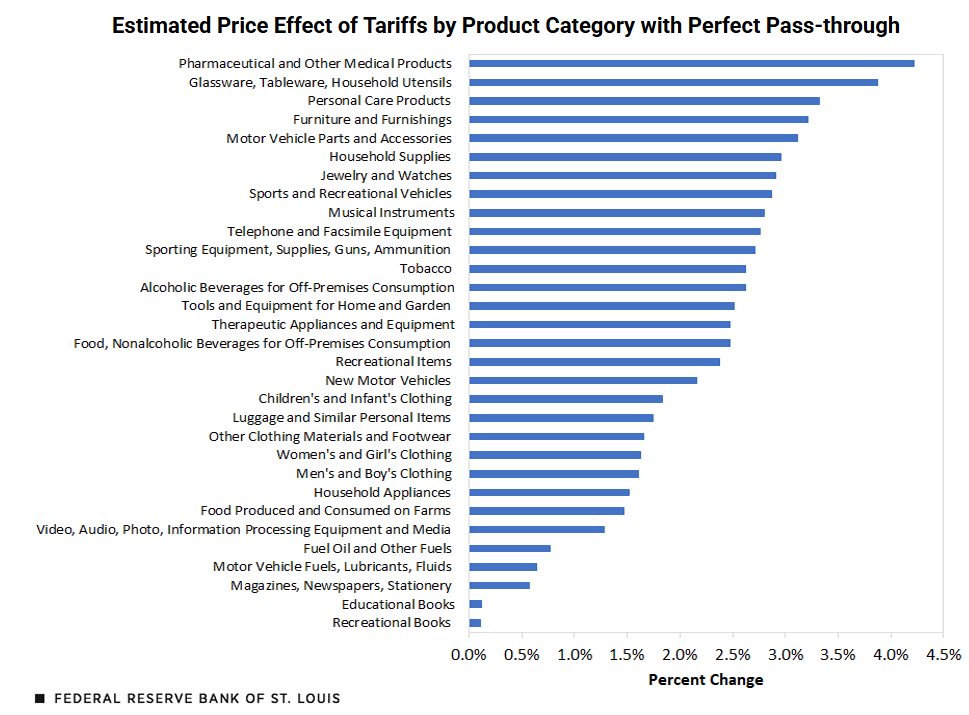

Tariffs have been a direct hit to low-value discretionary products. Early in the year, companies built inventory levels ahead of duties and absorbed costs through lower gross margins rather than raising prices immediately. That buffer is fading. Tariff effects are now showing up in inflation readings with inputs like coffee, furniture and, recently, clothing prices, which jumped 0.7% in September. The St. Louis Fed’s recent analysis shows the estimated price effect across categories once full pass-through begins.

Put together, these three forces explain why discretionary stocks lagged every sector tied to AI or policy tailwinds this year. Most names in the basket I am looking at have been pushed deep into value territory. In the last screen,

I noted:

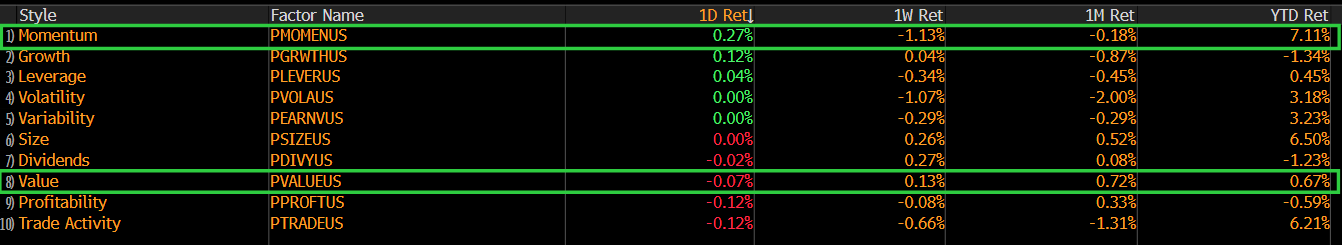

Well, that trend has surprisingly continued as momentum-driven names continue to take a breather. In fact, over the past month, the pure Value factor has outperformed Momentum.

Part of my broader thesis is that the long-AI/short-consumer trade unwinds in 2026 as the AI theme gets increasingly crowded. Last Thursday (11/13) confirmed how fragile the current momentum cycle is as worries about stretched AI valuations and hawkish Fed commentary knocked markets lower. The future unwind will be a result of the thesis, not the driver.

Overarching thesis for consumer discretionary in 2026

I want to be clear that this thesis carries more speculation than my typical single-stock work. These are expectations with a probability I assign of >50%. With that said, I break it into two major pillars.

First: tariffs.

This is probably the most fluid policy environment we have seen in years. Nothing stays in place for long. The October inflation and jobs reports still have not been released because of the shutdown, and there is a real possibility we never get them. Economists (who almost always get this wrong) estimate headline and core CPI at +0.3% MoM for October, which annualizes to ~3%, suggesting inflation is still persistent. But the key point here is that people keep treating tariffs as a one-time increase to inflation. That implies companies immediately passed on costs. That is not what has happened.

Companies pre-built inventory earlier this year to prepare for the duties, absorbed margin pressure, and delayed full pass-through. The real tariff effects are only now beginning to hit, and in the P14 view, the bigger impact will show up in November and December as holiday spending reveals what true end-consumer pricing looks like.

The administration appears to understand this. On 11/13, tariff exemptions were rolled out for cocoa, coffee, bananas, beef, and agriculture products. On the surface, this is framed as an “affordability push” after Democrats performed well by campaigning on cost-of-living issues in recent state and local races. Bloomberg’s reporting by Catherine Lucey and Ilena Peng spells this out clearly:

In the P14 view, this is only the beginning. Exemptions are likely to increase as we move deeper into the holiday season and the push for affordability will only rise as we move towards the midterms in 2026.

The second angle is the ongoing SCOTUS hearings on tariff legality. The transcripts show meaningful challenges from the Justices that remain unanswered. I do not assign a majority probability to tariffs being overturned entirely, but there is a real chance that effective tariff rates are cut sharply to pre-empt an adverse ruling. The current effective tariff rate is 18% per Yale’s Budget Lab. I think an effective rate closer to 10% in 2026 is highly likely. That would be a major positive for consumer names.

And if tariffs are overturned, we get an outsized upside event for consumer stocks. The long-AI/short-consumer trade is one of the most crowded trades of the year, so any ruling that invalidates tariffs will result in violent positive upside moves across the sector.

The important thing here is that most consumer discretionary companies have already issued tariff-adjusted 2025 guidance after the general increase in Q2. That means the margin hits and revenue adjustments are already embedded in estimates. Unless tariffs increase again (highly unlikely), the negative effects are priced in. With exemptions already starting, and effective rates likely to fall, consumer discretionary names are set up to outperform tariff-adjusted guidance in 2026.

Second: the consumer.

It should come as no surprise that the majority of GDP growth this year has come from AI/data-center–linked capex, with over 60% of 1H25 GDP growth driven by AI/tech investment and the remainder coming from consumption and other components.

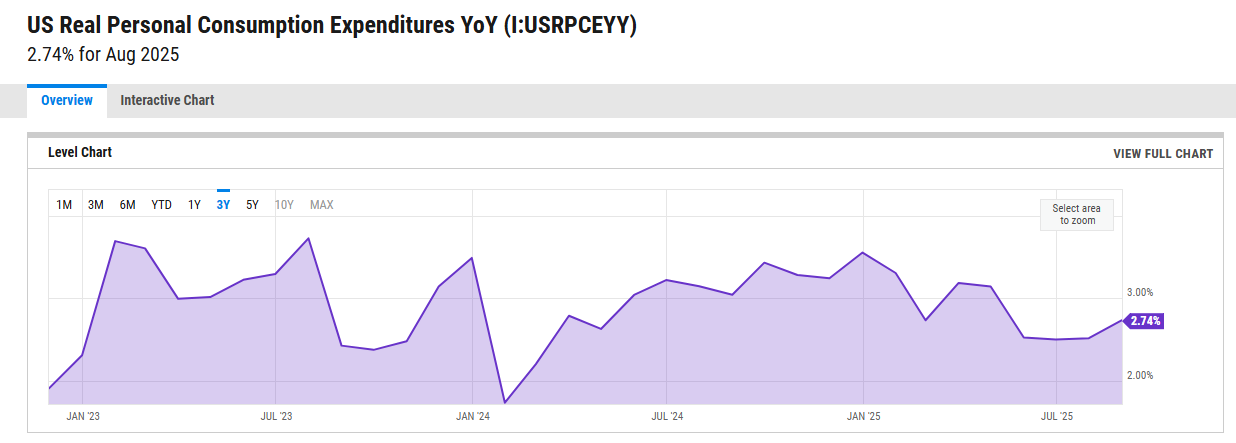

The Atlanta Fed revised Q3 GDP up to 4% on 11/3, likely due to a stronger ISM report and real PCE that remained resilient in August.

Everyone now expects weaker PCE in the months after September because of the government shutdown, softer travel spend, negative immigration, and a weaker holiday season. Retail hiring in October fell below pre-pandemic levels, with retail, hospitality, and food-service postings down 16% Y/Y based on Indeed Hiring Lab data. The NRF expects 265k–365k seasonal hires compared to 442k last year.

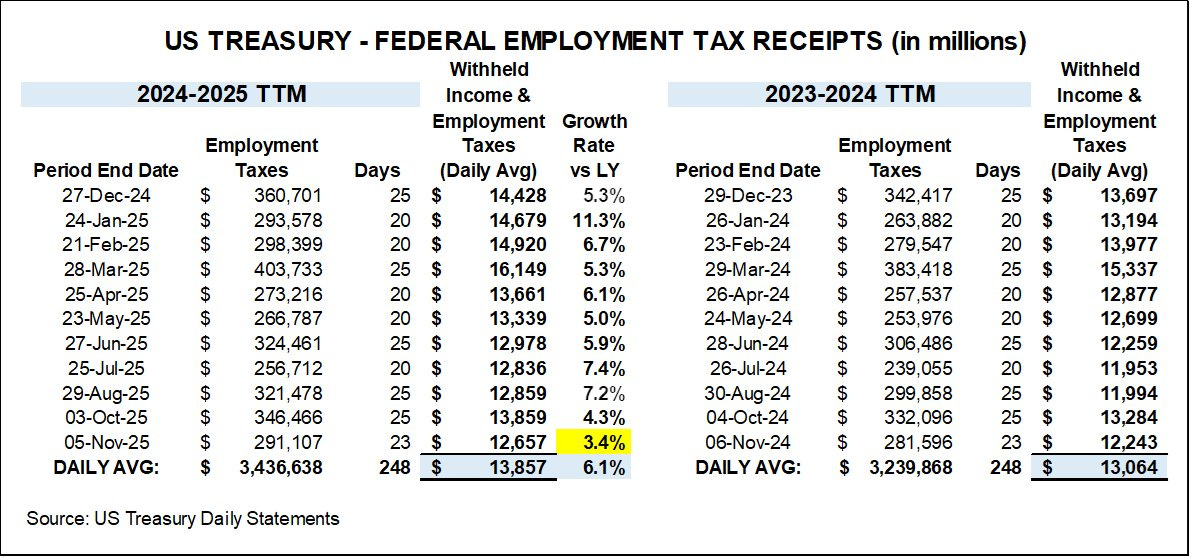

Especially now, with weaker employment numbers and the prospect of not receiving the October jobs report, it should come as no surprise that the data is softening given negative net migration, layoffs, and weaker seasonal hiring. At the same time, the labor market does not appear to be “tanking,” as federal employment tax receipts remain relatively stable, though slowing, despite the blip from furloughed government employees (growth would likely have been around 4% excluding the shutdown).

The point of laying all this out is simple. Expectations for weak consumer spending are already negative. The National Retail Federation is calling for 3.7%–4.2% Y/Y holiday sales growth, below 2024’s 4.3%, and some sell-side shops like DA Davidson expect closer to 3%. This weakness is already largely reflected in the depressed multiples across the consumer discretionary space. So the question becomes: what actually turns the table for the consumer?

The first factor is specific to the group of names I am targeting. These are lower-priced, low-value products. As stated earlier, most consumer spending post the stimulus era has been driven by wealthy households. Those same households have started watching their budgets more carefully. Value now matters across the board. Upper-income, middle-income, and lower-income consumers all want to feel like they are getting good value for their dollar. So while low-priced brands continue to feel pressure from lower-income households, the higher-income consumer has increasingly shifted toward bargains and value-focused brands. When a low-priced brand resonates with a wealthier shopper, that trade-down behavior can offset softness at the bottom. There are always product-level and brand-level nuances, but this broad pattern has shown up consistently throughout 3Q25 earnings. The CNBC piece by Amelia Lucas, Melissa Repko, and Gabrielle Fonrouge highlights this dynamic well:

At the end of the day, you should never bet against the American consumer. Recession odds get thrown around constantly, but nothing concrete has shown up in the data. What we do have is one of the worst periods of market breadth in years. AI-linked names continue to run while many consumer discretionary stocks have seen major multiple compression. In the P14 view, a lot of consumer names are already pricing in a holiday season weaker than both 2024 and what companies guided for in early 2025. Because of that, Q4 risk-reward is skewed to the upside, especially for value-oriented discretionary brands now picking up wealthier customers. The main risk is a break in the reflexive loop of rising asset prices → wealthy consumer confidence → resilient wealthy consumer spending. If that loop breaks, the holiday season could come in even weaker than already low expectations.

My thesis already assumes a weaker holiday season compared to last year. The more important part is the setup into 1H26. A holiday season that comes in weaker than an already weak baseline, especially due to affordability concerns, actually strengthens the case for a stronger rebound in 1H26. There are 3 reasons for this.

First, if tariffs meaningfully contribute to a weak holiday season, that directly increases pressure on the administration and on the ongoing SCOTUS hearings. A visibly soft Q4 driven by tariff-related inflation makes it more likely that tariffs get reduced, rolled back, or carved out further. Even without SCOTUS, an inflation surprise practically forces broader tariff exemptions. The administration is extremely sensitive to stock market performance, so any clear link between tariffs and consumer weakness raises the probability of meaningful tariff relief.

Second, tax refunds. Refunds are set to rise next year because the One Big Beautiful Bill Act made major tax cuts retroactive to January 2025 while the IRS continued using the old withholding tables. Workers have been overpaying all year. Oxford Economics estimates roughly $50B in additional refunds or lower tax bills in early 2026. Low-income households benefit from the higher $15,750 standard deduction for single filers and $31,500 for married couples and from inflation-adjusted refundable credits. Higher-income households benefit from wider permanent brackets and the increased $40,000 SALT cap. JPMorgan’s David Kelly notes that early filers in January and February will receive the biggest checks first.

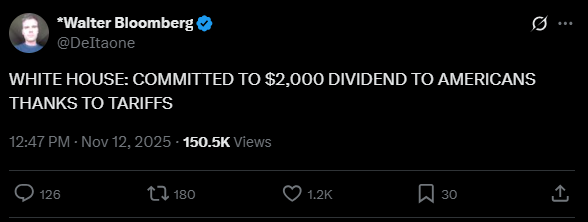

Third, the tariff dividend idea is still circulating. A $2,000 tariff dividend check has been floated both as a way to offset affordability issues and as part of the political backdrop around SCOTUS. I assign a low probability to this actually happening, especially after Scott Bessent suggested any benefit would instead show up in tax filings, would need congressional approval, and would likely be limited to earners under $100K. But low probability is not zero, particularly if tariffs remain in place and the holiday season disappoints.

In the P14 view, a full-blown recession is unlikely, especially with QE set to begin and the Fed expected to lean dovish. The economy is being set up to run hot in 2026. Inflation risk looks underpriced and we could be in for a 2021 repeat. All in all, the setup for consumer discretionary is skewed to the upside. Tariff effects are already priced in, and the effective tariff rate is more likely to move lower than higher. A weak holiday season increases the chance of sharper tariff relief. If SCOTUS rules tariffs illegal, the sector gets a positive, near–black-swan catalyst that the market is not positioned for at all.

In the P14 framework, it is reasonable to expect consumer spending to accelerate in 1H26, driven by bigger tax refunds, lower effective tariff rates, and even the small possibility of a tariff dividend.

Now the important part: how do you play this? Below is my current consumer watchlist. These are companies with strong balance sheets, idiosyncratic drivers such as marketing strategy pivots, a value-goods focus that appeals to wealthier consumers in Q4 and to lower-income consumers in the 1H26 rebound, solid capital returns programs, and meaningful tariff exposure that creates asymmetric upside.