Euronet Worldwide, Inc.

NASDAQGS: EEFT | 04/17/2025

2025 is shaping out to be the stock-picker’s year. As the U.S. economy approaches (or may already be in) a slowdown, my focus at P14 Capital has remained anchored on identifying mispricings in high-quality businesses that offer non-discretionary services—those that are essential yet represent a small portion of consumers’ budgets. One such company is Euronet Worldwide, Inc. (EEFT), a core holding in the P14 Capital portfolio for nearly a year.

Thesis Summary

EEFT has been a laggard over the past 12 months, hovering around the $100 mark before falling to historically low valuation levels during the broader equity market sell-off. Despite resilient operational performance, the stock has been unfairly discounted, particularly due to perceived headwinds in its Money Transfer segment tied to U.S. immigration policy. However, recent data shows that fears around mass deportations are overstated, and EEFT’s exposure to at-risk corridors—especially the U.S.–Latin America remittance market—is far more limited than the market assumes.

Management remains highly conservative in its guidance, consistently setting EPS growth targets in the 10–15% range only to exceed them. Over the last 10 years, EEFT has grown EPS at a 13.5% CAGR. Notably, in the most recent call, management guided to 12–16% EPS growth in 2025, signaling confidence despite their historically cautious tone. Capital allocation has been disciplined: the company has actively repurchased shares at depressed valuations, further supporting EPS compounding.

EEFT is well-positioned to benefit from multiple tailwinds. In the EFT segment, increased interchange and surcharge fees—particularly as more countries enable domestic access fees/surcharges—are boosting take rates and profitability. REN, Euronet’s proprietary payments platform, is contributing incremental high-margin growth, with 60%+ EBITDA margins versus ~25% for ATM-specific business. Meanwhile, the Money Transfer segment is seeing a structural mix shift toward digital, where margins are higher due to the absence of physical agent commissions.

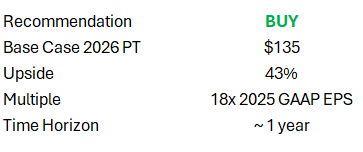

EEFT trades at just 14.7x TTM P/E—far below its historical valuation for a consistent earnings compounder. Continued execution and a modest multiple re-rating to 18x GAAP P/E, which is where the stock traded post-4Q23 results, implies ~43% upside within the next year.

Business Overview

Euronet Worldwide, Inc. was founded in 1994 by Michael J. Brown with the vision of establishing the first independent, non-bank-owned ATM network in Central and Eastern Europe. The company has since expanded into digital payments, retail content distribution, and cross-border money movement through organic growth and acquisitions. Today, Euronet provides payment and transaction processing solutions to financial institutions, retailers, service providers, and consumers across 200+ countries and territories.

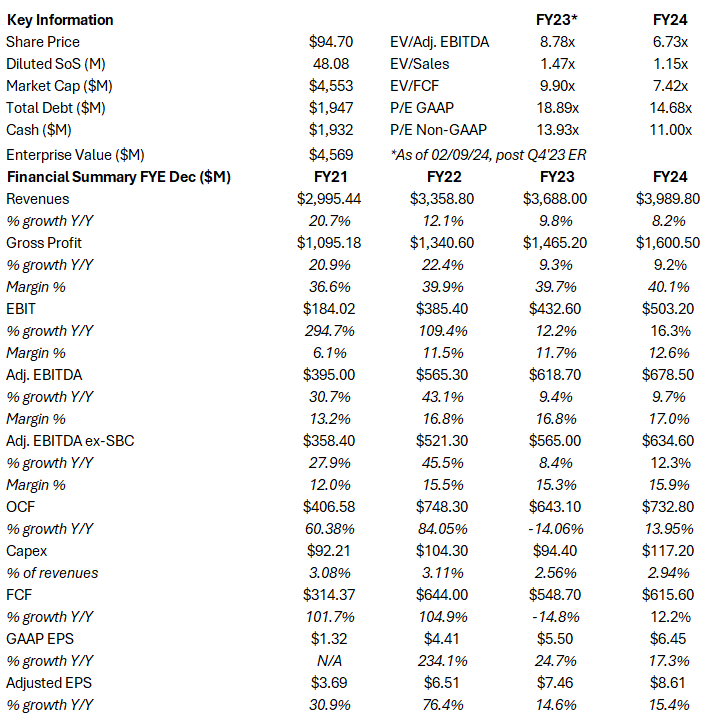

In 2024, Euronet generated $3.9B in revenue (+8.2% Y/Y), operating through three segments: Electronic Fund Transfer Processing (EFT), epay Solutions (epay), and Money Transfer.

EFT Processing (29% of revenue, +9.7% Y/Y) – Operates 55,248 ATMs and ~1.16M POS terminals across Europe, the U.S., Asia Pacific, LATAM, the Middle East, and Africa. Offers outsourced ATM/POS services, card issuing/acquiring, digital content distribution, DCC, surcharge access fees, Ren-powered software solutions, and value-added services like mobile top-up and bill payment. Key revenue streams include transaction fees, FX margins, and recurring network management fees.

ePay (29% of revenue, +6.3% Y/Y) – Distributes digital content, prepaid airtime, open/closed-loop gift cards, and payment products via a network of 777,000 terminals in 362,000 retail locations across 60+ countries. Partners with 1,000+ global brands and delivers content through both physical and digital channels. Revenue primarily derives from commissions and processing fees on prepaid content sales, with 76% of gross profit from non-mobile content.

Money Transfer (42% of revenue, +8.4% Y/Y) - Operates global money movement under Ria, Xe, and Dandelion brands across 608,000 payout locations in 198 countries. Offers C2C transfers, B2B cross-border payments, FX risk management, and real-time payouts to bank accounts, wallets, and cash agents. In 2024, processed $71.3B in remittance volume across 176.9M transactions (+9.4% Y/Y). Revenue is generated via send fees and FX spread, with digital payout accounting for 54% of total volume.

Thesis Detail

Addressing the Overhang: Impact of a “Stricter” Immigration Policy on EEFT

Recent data confirms that deportations are trending lower than the market fears. In March 2025, there were 18,500 deportations—down from 23,100 in March 2024. Annualizing the March 2025 figure yields roughly 222,000 deportations for the year, below the 271,000 deportations in FY24. While this estimate doesn’t capture changes in new immigration inflows (which are declining from 1–2M in recent years to an est. ~500K in 2025), it highlights that fears of mass-scale deportations are overstated.

More importantly, remittances remain a non-discretionary expense for working-class immigrants. Approximately 80% of migrants send money home to cover essential needs like food, rent, and medicine. This economic reality makes remittance demand highly resilient—even under restrictive policy environments.

A significant portion of market concern around stricter immigration policy centers on the U.S.–Latin America and Caribbean (LAC) remittance corridor. Despite these concerns, remittances in this corridor are still projected to grow 3–5% in FY25. At ~$160B in FY24 transaction volume, the US–LAC remittance market is one of the largest globally. Notably, Ria’s market share remains modest at 11.6%, trailing peers like Remitly (22.7%) and WU (16.8%.)

Assuming the market grows at the low end of 3% in FY25 and Ria holds its 11.6% share with an average take rate of 2%, this implies ~$382M in US–LAC revenue for EEFT. That equates to roughly 23% of the company’s FY24 Money Transfer revenue and 10% of total revenue. In a conservative downside scenario where 20% of this corridor's revenue were to be lost—an outcome I view as unlikely—the impact would represent just a ~2% reduction to my FY25E total revenue forecast of $4.35B (+9% Y/Y), which remains a manageable risk given EEFT’s diversification beyond money transfer.

Importantly, many Latin American immigrants who send remittances are employed in essential sectors like construction, services, and agriculture. Over 20% of Mexican immigrants, for instance, work in construction. These industries have been explicitly cited by the current administration as being largely insulated from enforcement action. As stated by the President: “We have to take care of our farmers, the hotels and, you know, the various places where they tend to need people.”

The EFT Segment – Take Rate Expansion, Travel Tailwinds, and Ren

A core pillar of the long EEFT thesis lies in the improving economics of the EFT segment. Following the pandemic, interchange fees—set by card networks and paid by card-issuing banks—remained stagnant despite rising ATM operating costs (labor, maintenance, hardware). In response, Euronet filed suit against Visa and Mastercard, ultimately prevailing in October 2023. Since then, interchange rates have begun to rise.

More importantly, several countries have adopted more flexible policies around surcharges, particularly Domestic Access Fees (DAF)—flat fees paid directly by the consumer, typically ranging from $2.50 to $5.00 per ATM transaction. In 2024 alone, more than four countries introduced or raised surcharge caps. Because EEFT sets these fees independently, 100% of surcharge revenue flows directly to operating profit, unlike interchange fees. While not fully visible in revenue per transaction metrics—due to a concurrent mix shift toward lower-value transactions—the impact on EBITDA margins is clear. As shown below, EFT segment margins have consistently expanded Y/Y across the last eight quarters.

The segment also benefits from seasonal strength. Q3 is typically the strongest quarter due to peak travel activity, particularly in Europe and Asia. While data shows a slowdown in European travel to the U.S., intra-European travel is rising, and Euronet’s extensive ATM footprint across tourist-heavy European corridors positions it to benefit. Increased travel volume correlates with higher Dynamic Currency Conversion (DCC) activity, ATM usage, and fee capture—especially with surcharges trending higher.

Additionally, Ren, Euronet’s proprietary payments platform, is a major structural growth and margin driver. Launched in 2019, Ren is a cloud-native, microservices-based real-time payments infrastructure used internally and licensed externally to banks, central banks, and fintechs. Ren is both database- and platform-agnostic and supports issuing, acquiring, switching, and ATM management. It is deployed via both on-premise and SaaS models.

Because Euronet is both a user and provider of Ren, the platform evolves in real time based on operator needs. Management has described revenue growth from Ren as hyperbolic rather than linear, with usage compounding post-implementation as more card volumes and real-time payments flow through the system. As a software-based product, Ren commands EBITDA margins of 60–80%, significantly higher than the ~25% margins typical of ATM-specific services. While Euronet does not break out Ren’s contribution explicitly, commentary suggests it generated 15% of EFT revenue and 20–25% of EFT EBITDA in FY24.

With these combined tailwinds—interchange and surcharge expansion, favorable travel patterns, and continued scaling of Ren—I forecast EFT segment revenue to grow +12.2% Y/Y to $1.3B in FY25, with EBITDA margins expanding +200 bps to 32.4%.

The Narrative Shift – Not Just an ATM Operator

A key but often underappreciated aspect of the EEFT story is its evolving identity—from a traditional ATM operator to a diversified, tech-enabled payments platform. While the EFT segment’s ATM business continues to serve as a reliable cash-generating asset, the growing scale and adoption of Ren is reshaping how the company is perceived. Ren and other digital-native initiatives are positioning the company closer to a fintech model—an identity that commands structurally higher earnings multiples.

This sentiment was clearly articulated by management in the Q4’24 earnings call. CEO Michael Brown reflected: “I could not help but wonder why the market does not always share my enthusiasm about Euronet's results and our future opportunities. For instance, an analyst once told me, ‘you guys are great operators here at Euronet, but I don't see a future for your model.’ That made me realize we need to clarify precisely what we built and why Euronet is a well-positioned business operating in a very large market with multiple diversified revenue streams poised to produce growth in the future. Today, only 19% of our revenue is generated from Euronet-owned ATMs… Said differently and simply, while I am very proud of our heritage, we're not just in the ATM business.”

This sentiment echoed by management reflects a broader narrative shift. Going forward, management will likely begin breaking out emerging services such as REN, Dandelion, and Merchant Services more explicitly—signaling to the market that Euronet is no longer a cash-centric business, but one that is increasingly aligned with a digital and fintech-oriented strategy. This repositioning, if effectively communicated and supported by segment-level disclosures, will likely result in the business commanding higher valuation multiples over time.

Interestingly, the market’s outdated perception of Euronet as a cash-centric business could become a defensive advantage. In recessionary environments, consumers often prefer the security and tangibility of cash. Furthermore, with cash usage stabilizing in many regions and the pace of digital displacement plateauing, the ATM business could enjoy a longer runway than previously expected.

Increasing digital adoption in Money Transfer

Euronet’s Money Transfer segment is the second largest by transaction volume market share globally, with a 7.8% share of the $881B remittance market—trailing only Western Union (11%). Despite this scale, EEFT continues to trade at a deep discount to more digitally native peers like Remitly and Wise. The valuation gap stems largely from growth perceptions: Remitly and Wise have historically outpaced Euronet in revenue growth, driven by their fully digital operating models.

However, the narrative is starting to shift. EEFT has been aggressively expanding its digital money transfer footprint. As of FY24, an estimated 40% of segment revenue was digitally originated, compared to 60% from in-person (agent-based) channels. With direct-to-consumer digital transactions growing rapidly—as seen below—EEFT is well-positioned to capture a greater share of global digital remittance volume. This also presents a sizable runway for growth, as only ~40% of global remittance transactions are currently digital.

The main structural headwind in the segment has been the U.S. domestic cash-to-cash business, which has seen Y/Y transaction declines in the range of -13% to -17% over the past several quarters. While this legacy business continues to decline, its overall contribution to segment revenue is limited. Importantly, management is actively reallocating resources—particularly toward digital customer acquisition—by increasing digital marketing spend to drive adoption and build scale.

As digital mix improves, Money Transfer margins are expected to follow. Digital transactions carry structurally higher margins due to the absence of agent commissions and greater operating leverage. While the margin benefit has been muted over the past eight quarters—held flat by upfront marketing costs—the long-term impact remains accretive.

Taking a conservative view amid a softer macro backdrop, I forecast Money Transfer revenue to grow +8.5% Y/Y in FY25, a modest 20 bps acceleration over FY24. I also anticipate EBITDA margin expansion of ~30 bps to 13.75%, driven by continued digital mix shift partially offset by elevated marketing investments.

Valuation and Conclusion

EEFT is currently trading at a trough valuation of 14.6x GAAP P/E, well below historical averages for a business that has compounded GAAP EPS at a 21% CAGR over the past two years and 13.5% over the last decade. This is a remarkably low multiple for an earnings compounder undergoing a structural transformation—from a legacy cash-based operator to a fintech-driven platform company. With management now actively repositioning the narrative and business mix toward high-margin digital platforms, a re-rating toward historical valuation levels is both conservative and justified.

Based on my base case, I estimate EEFT will generate $7.50 in GAAP EPS in FY25, reflecting +16.4% Y/Y growth—a figure at the top end of management’s 12–16% guidance range. Notably, this estimate is itself conservative, considering the company delivered +17.3% GAAP EPS growth in FY24.

Applying a modest re-rating to 18x GAAP P/E—in line with the multiple EEFT traded at following its FY23 earnings—implies a target price of ~$135, or 43% upside over the next 12 months post-FY25 results.

Downside appears limited. At current valuation levels, the stock already trades as if the bear case is playing out. In a less favorable scenario, where revenue momentum slows or multiple expansion fails to materialize, I expect shares to remain supported in the mid $80s to low $90s range, consistent with recent trading behavior during broad market pullbacks.

In summary, EEFT offers a compelling risk-reward profile—anchored by consistent execution, emerging digital growth levers, margin tailwinds, and a clear path to multiple re-rating as the market begins to reframe the company's narrative.

Disclaimer: Nothing posted by P14 Capital should be considered financial advice. The author of this post holds a long position in EEFT. Please consult a financial advisor and/or conduct your own due diligence before making investment decisions.

What do you use for market data on your key information/KPI sheets? Tell me you’re not filling those in manually!