Viant Technology Inc.

NASDAQGS: DSP | 06/27/2025

P14’s curious adventures in adtech continue… I view adtech as a prime source of outsized returns amid still-low sentiment in digital advertising. After researching IAS and being impressed by its CTV tailwind, I branched out across the ecosystem and landed on DSP—Viant Technology, a business with multiple catalysts and tailwinds for top-line growth, all while sitting at a bottom-line inflection point.

Thesis Summary

DSP’s track record has been marred by misunderstood acquisitions and inconsistency tied to macro-sensitive ad channels. Today, programmatic’s rapid expansion and the company’s shift into resilient CTV have strengthened its foundation, and its first-to-market AI products are generating genuine advertiser buzz.

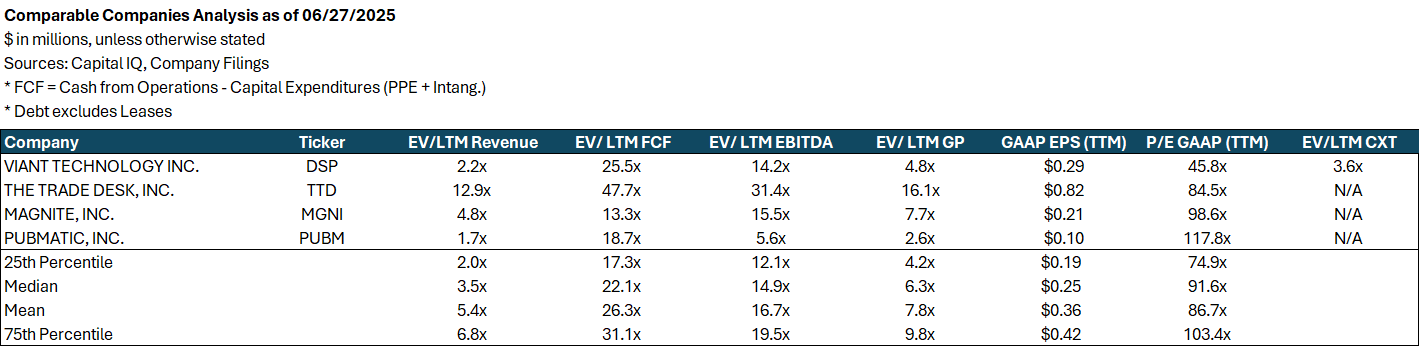

After rebounding from 2022’s underperformance—driven by a recession that never materialized and a customer pricing mix shift—and growing revenues 1.5x since then, Viant still trades at just 2.2x EV/Sales, a serious discount for a company with a long runway of high double-digit revenue growth. Its EBITDA story is similar: at 14.2x, it understates momentum, even as adjusted EBITDA jumped 53% in FY24 and is on track for a ~30% CAGR over the next three years. On a GAAP basis, Viant stands at a profitability inflection, as strong top-line growth, disciplined opex control, and tailwinds to Contribution ex-TAC drive bottom-line conversion.

The shift to contextual, cookie-less targeting plays directly to Viant’s patented Household ID. New offerings like Direct Access are already driving incremental gross ad spend, and given Viant’s smaller base versus larger peers like TTD, each share of market penetration yields outsized revenue. Management has stepped up IR—adding analyst coverage and conference appearances—positioning Viant as a “mini-TTD.”

Further tailwinds to gross ad spend include the opportunity from Microsoft’s Xandr shutdown and the upcoming Direct Access integration with Netflix. A speculative upside—already priced into SSP peers like Magnite and PubMatic but not yet into Viant—is the potential breakup of Google’s ad business. With a $200M free-float market cap (~15M shares) and ~8% short interest, Viant’s limited liquidity could spark a short-squeeze-like rally if key catalysts and earnings beats materialize.

The market isn’t pricing in these dynamics. At 15x EV/EBITDA on FY26 estimates, Viant offers ~49% upside to $19.80/share. Applying a conservative 3x EV/Sales multiple to FY26 sales implies a $22.40 PT (+69%). A 60/40 blend of 3x EV/Sales and 15x EV/EBITDA yields an FY26 PT of $21.40, +61% upside from current levels.

Business Overview

Founded in 1999 as Specific Media by industry veterans Chris, Tim and Russ Vanderhook—often called the “adtech bros”—Viant was among the earliest innovators in digital advertising. In 2011, Specific Media, alongside Justin Timberlake (lol), acquired Myspace for $35M to build its identity graph—later evolving into Household ID. In 2016, Time Inc. purchased a 60% stake (assumed by Meredith in 2018), and in 2017, Viant acquired Adelphic, marking its full transition to a pure-play DSP. Today, the business remains founder-run, with Chris and Tim collectively owning ~70%.

From a home-office startup, Viant has grown to 376 employees across 10 North American offices. It priced its IPO at $25/share in February 2021 and closed at $65/share on day one—unsurprising amid a broad market melt-up that year.

As a demand-side platform (DSP), Viant provides programmatic media-buying software to >300 active customers—primarily agencies and mid-market advertisers—enabling programmatic buys across CTV, streaming audio, display, mobile and DOOH with a people-based identity framework and AI-driven bidding. Its patented Household ID translates 1.5B+ IP addresses and identifiers into 115M households and links them to ~1B connected devices. First-party data activation and real-time forecasting help clients target more precisely and measure campaigns holistically, all to improve return on ad spend (ROAS).

In the LTM (1Q25–), Viant generated $306.5M in revenue (+30.6% Y/Y) and adjusted EBITDA of $46.8M (+43.6% Y/Y), a 15.3% margin (+138 bps expansion). Revenue is primarily generated through a percentage-of-ad-spend (platform fees) model with additional data, identity and add-on fees, as well as a minority contribution under a fixed-CPM model. Viant offers both self-service (85% of gross ad spend) and managed-service (15%) options. Most of the revenue line is recorded on a net basis, where Viant acts as an agent for media spend. Excluding traffic acquisition costs (TAC) paid to SSPs/publishers, Viant reports Contribution ex-TAC (CXT)—effectively non-GAAP gross profit—of $186M (+24.9% Y/Y).

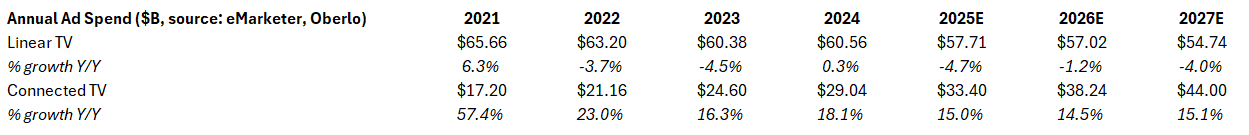

Viant’s markets are in secular growth. The company estimates its TAM—the U.S. advertising market—at $403B, growing at an 8% CAGR to $471B by 2027. Within that, U.S. programmatic advertising is projected to grow from $136B in 2023 to $202B in 2026 (14% CAGR), and CTV—the company’s largest channel—is forecast to expand from $33B in 2025 to $44B in 2027 (15% CAGR).

Viant is one of two pure-play, publicly traded DSPs, alongside The Trade Desk (TTD). Viant is significantly smaller—TTD is ~42x larger by market cap and ~8x larger in revenue.

Thesis Detail

Outgrowing an inconsistent history

Viant acquired MySpace in 2013 not to drive ad revenue directly but to build an identity graph that later evolved into its Household ID—contrary to the market’s belief that it was an ad-revenue play. That long-term vision continues to be misread: IRIS.TV and Lockr acquisition announcements in FY24 were met with negative price action and analyst skepticism despite both deals (financials undisclosed) reinforcing Viant’s addressability and CTV initiatives.

In 2022, surging inflation and looming recession fears triggered a sharp pullback in ad spend among Viant’s small, mid-market customer base. Simultaneously, a pricing-mix shift—from fixed-CPM deals (which recognize revenue before deducting TAC) to percent-of-ad-spend contracts (where revenue is reported net of TAC)—created a near-term drag on reported revenue and Contribution ex-TAC. This pricing shift coincided with active customers declining from 327 in 1Q22 to 301 in 3Q23, as Viant deliberately moved away from lower-spend segments and prioritized onboarding higher-value clients. The strategy paid off: percent-of-spend customers now spend 3x more than fixed-CPM accounts and exhibit materially higher retention rates.

Macro headwinds drove a –13% Y/Y drop in auto and CPG spend in Q2 2022, while retail—Viant’s largest vertical—decelerated sharply in Q3 and turned negative in Q4. Each sector represented >15% of the 2022 mix, so their cutbacks disproportionately weighed on revenue. Legacy channels—display and desktop—suffered double-digit declines industry-wide, driving a –12% Y/Y revenue decline for FY22. By contrast, peers like TTD and leading SSPs delivered strong growth, buoyed by diversified channel mixes, larger enterprise clients and established percent-of-spend models.

Fast-forward to today, and the market continues to price in pessimism based on Viant’s inconsistent history: analysts forecast only +17.2% Y/Y growth. Yet we’ve seen adtechs sandbag guidance early in the year due to advertiser uncertainty only to beat in subsequent quarters: DV, IAS, TTD and DSP itself guided +25% Y/Y for 1Q25 but delivered +32%. Viant’s choice not to provide full-year guidance keeps consensus conservative. That cautious view stems largely from its tepid Q2 guide—+19% Y/Y revenue and +17% Y/Y CXT—which reflects a 3–4% deferral of Q2 budgets into H2 due to tariff uncertainty, not structural weakness. Fewer than ten advertisers—almost exclusively in consumer goods and retail—postponed those dollars. Management’s confidence in the return of the spend stems from its DSP order-entry system—rescheduled budgets show up as firm line-items—ensuring the deferred 3–4% of Q2 spend will flow in H2. Recent tariff pauses should further bolster advertiser certainty and drive the return of that spend.

The market’s view today underestimates how the business has changed since 2022:

Improved vertical and customer diversification. In 2022, autos, CPG and retail each accounted for >10% of spend, with several advertisers >5% individually. Today, no vertical exceeds 15% and no single advertiser exceeds 5%. Top verticals now include healthcare, public services, retail, CPG and travel/tourism, with modest exposure to durables, industrials, dining, professional services and real estate—and auto exposure skewed toward local services (oil-change shops, gas stations, dealers) rather than OEMs. In 1Q25, management noted they “under-index in automotive and retail.” Moreover, with the bulk of its customer mix now structured as percent-of-ad-spend contracts, these customers have proven far more resilient through macro swings and exhibit higher retention rates than fixed-CPM accounts.

Shift to CTV-dominated spend. Viant has rapidly expanded its roster of CTV advertisers, targeting the high-growth, early-stage ad-supported streaming market. CTV’s real-time programmatic control, granular impression data and brand-safe environments drive >90% ad-pod completion rates—resulting in lower effective cost per completed view. More than half of the large brands now allocate over 40% of their budgets to CTV. In downturns, performance-focused advertisers shift budgets fastest to the highest-ROAS channels, and Viant’s established CTV niche stands to benefit disproportionately.

Viant’s niche and why it has staying power

Advertisers increasingly chase the highest-ROAS channels, a trend amplified during economic downturns. Any macro-driven pullback—like in 2022—accelerates the shift from linear TV to CTV, a roughly $60B reallocation opportunity industry-wide, as performance-focused buyers reallocate budgets.

That performance focus is not theoretical. In Ebiquity/WFA’s 2025 Media Budgets Survey, 42% of respondents planned to increase performance-marketing spend (i.e. ROAS-driven tactics), versus just 24% boosting branding budgets. Mid-market players drive this shift whereas most enterprise advertisers still devote large share to broad-reach and brand campaigns.

Viant’s core customer base falls into that mid-market segment—typically $50M–$1B in annual ad spend—where selectivity on channel choice is paramount. Unlike large brands that prioritize reach, these advertisers prioritize data-driven efficiency and will pay premium CPMs if ROAS justifies it. CTV delivers the highest ROAS, making it a natural fit for Viant’s mid-market focus.

Supporting that shift, Viant’s patented Household ID translates 1.5B+ device and IP signals into 115M U.S. households—covering ~80% of biddable inventory and >90% of CTV bid-stream—while cookies account for <10% of spend on the platform. Over the past two years, revenue and Contribution ex-TAC tied to Household ID have grown more than eightfold, underscoring both advertiser demand and retention.

To onboard advertisers without in-house ad ops, Viant offers a managed-to-self-service pathway: its team handles campaign setup, bid optimization and reporting initially, then transitions clients to self-service once they’re up to speed (typically 6-12 months). The Trade Desk, by contrast, provides only self-service access—forcing mid-market buyers to build trading-desk capabilities internally or outsource. Viant’s approach accelerates time-to-performance and lowers adoption barriers, cementing its advantage among data-driven advertisers.

With an estimated 10M small businesses, performance marketers and DTC e-commerce firms driving over $100B in U.S. search and social spend, Viant stands to capture a significant reallocation of that budget into more effective channels. Its Addressability Solutions—Household ID and IRIS ID—enable precise, contextually relevant targeting and transparent lift measurement, while Viant AI simplifies the DSP interface for those advertisers. In an era defined by performance, Viant’s combination of data-centric identity, CTV expertise and managed-service support gives it a durable niche in the open-internet ecosystem.

Viant vs TTD, does TTD pose a major threat?

TTD is the undisputed pure-play behemoth of the industry—first-mover advantage, enterprise customer base, global scale and early product innovation have driven its growth. Viant is nowhere close to displacing TTD’s largest accounts, and this is not a pair trade (Long DSP, Short TTD) thesis.

TTD trades at 12.9x EV/Sales with +25% Y/Y growth in the LTM versus Viant at 2.2x EV/Sales with +31% Y/Y growth. Because TTD reports revenue net of pass-through costs, EV/CXT is a fairer comparison: 12.9x for TTD versus 3.6x for Viant (both ~+25% Y/Y). On EV/EBITDA, TTD trades at 31.4x with a 41% margin and +28% Y/Y growth, compared with Viant at 14.2x with a 25% CXT margin and +43.6% Y/Y growth. The multiple gap is excessive, with TTD’s presence actually being beneficial to Viant as opposed to the market’s perception of Viant being a target for absolute disruption by the competition.

This view primarily arises from four factors: Viant’s mid-market client base and the actual value it adds them; the CTV tailwind; and gross-media-spend take-rates far cheaper than TTD’s.

Viant is growing its CTV business faster than TTD, benefiting from the SMB CTV tailwind and much lower media-spend take-rates. That rapid growth means Viant is capturing incremental share of the DSP market—not by poaching large TTD accounts, but by winning small, data-driven advertisers frustrated by the industry’s egregious fees. TTD reports a total average take-rate of ~20% that has stayed consistent over the past few years, whereas Viant’s take-rate—undisclosed but estimated via management conversations and industry experts—is slightly north of 20% and rising. According to my estimates, the take-rate for FY24 was 21%—split roughly 10% for media-spend fees and 11% for add-ons (Household ID, data fees). TTD does not break out platform vs. add-on fees, but it’s reasonable to assume ~10–15% media spend and ~5–10% data. It may seem odd that a much smaller Viant appears slightly more expensive, but that masks how TTD’s rates vary: its largest advertisers (e.g., P&G) secure deep volume discounts well below 20%, so to maintain an overall 20% average, TTD must charge its small/mid-market clients much higher rates. Those are the advertisers complaining of TTD’s fees—and precisely the cohort Viant is poised to capture.

Price isn’t Viant’s only shield against TTD. The other is AI. Unlike many software companies that dabble in AI labels, Viant has shipped top-tier, first-to-market AI products. The Viant AI suite consists of four phases, two of which are live today:

AI Bidding (launched Q3 2023): Advertisers enable Viant’s algorithms to find and buy optimal ad placements across the open web, minimizing cost while meeting KPIs. As of Q1 2025, AI Bidding automates 85% of spend on Viant’s platform (up from 80% in Q4 2024), driving a 75% Y/Y lift in Contribution ex-TAC related to AI Bidding. By comparison, TTD’s equivalent, Kokai (launched Q2 2023), covers ~67% of spend.

AI Planning (launched Sept 2024): Advertisers define targets (audiences, budget, ROAS goal, channels, flight dates) in a chat-like interface and hit “Launch.” Viant AI instantly translates that plan into DSP instructions—line items, insertion orders, bid strategies, frequency caps and creatives—and auto-traffics via API calls. The model is trained on ~98 trillion budget-channel-publisher-format combinations drawn from platform data, distilling them into a digestible, actionable media plan without manual setup. TTD lacks any chat-based planning tool.

The next phases are AI Measurement & Analysis (launching imminently), which provides on-demand insights in seconds, and AI Decisioning (H2 2025), which will grant Viant AI autonomy to manage media plans dynamically. Unlike opaque black boxes, Viant AI remains fully transparent—surface-level metrics, publisher allocations, clearing prices, ROAS data and more.

Viant’s AI bidding module charges a 20% fee on savings generated; the other three phases currently carry no explicit fees but rather focus on encouraging incremental spend. This contrasts with TTD’s hidden fees on volume-disadvantaged small/mid-market advertisers. By aggressively rolling out Viant AI to SMB and mid-market clients—who lack in-house ad ops—Viant offers turnkey, performance-driven tools without the complexity or cost burden of larger platforms.

In its current form, Viant AI builds detailed media plans and manages continuous bidding, and the goal is a fully autonomous DSP by year-end. The convergence of search/social displacement, CTV prioritization and Viant AI’s simplicity should attract data-driven advertisers to Viant.

Recognizing this momentum, Viant AI even took shots at The Trade Desk during the recent Cannes festival.

Other “Supposed” Competitive Pressures

If you follow adtech, you’ve heard the hype: Amazon is muscling into open-web DSPs and supposedly spells doom for incumbents. In reality, Amazon’s true threat lies elsewhere—against The Trade Desk and Google’s DV360—rather than a nimbler, mid-market-focused player like Viant.

Amazon’s DSP sits amid a conflict of interest: it steers a large portion of client budgets toward its own inventory—Sponsored Ads on Amazon.com, its retail-media network and Prime Video—capturing full margin and skewing attribution to in-house properties. Publishers, aware of this built-in bias, hesitate to share addressable signals (audience or contextual data) that would strengthen Amazon’s identity graph and further lock ad dollars inside its walled garden. As a result, Amazon DSP seldom appears in RFPs outside retail-media deals. It’s also prudent to note that Viant is under-indexed in retail as a vertical.

Where Amazon does win share is in retail-media—displacing Google search—and in driving premium e-commerce placements, not in the open internet where Viant operates. Its first-party data, while formidable within Amazon’s ecosystem, has limited utility beyond it: what signals will Netflix, Disney or other CTV publishers feed into Amazon, a competing streaming service? Virtually none. By contrast, Viant enjoys broad data-partnership cooperation across the open web, powering addressable campaigns at scale. With roughly 80% of biddable inventory addressable and 95% household coverage in its ID graph, Viant delivers true neutrality, transparency and performance—qualities that mid-market advertisers prize and that Amazon’s conflicted DSP cannot match.

Another often-cited threat is agentic AI—autonomous marketing agents that promise end-to-end campaign automation. Vendors such as Albert.ai, Salesforce’s Agentforce, HubSpot Breeze, Scope3’s Agentic Media Platform and Classify’s ContentGraph™ are racing to launch in 2025; holding companies alone invested over $600M last year. Yet these solutions focus on enterprise CRM, brand safety or open-web contexts—not self-service, CTV-centric DSP workflows for SMBs. Viant, by contrast, already embeds “digital labor” in its AI bidding and planning modules, with transparent, performance-driven fees and a managed-to-self-service path. That gives Viant a de facto first-mover advantage where true agentic autonomy meets CTV and mid-market needs. Brushing past the agentic noise, a much more important theme emerging in adtech is CTV among small-to mid-market advertisers.

Riding the CTV Tailwind

One of the brightest spots in digital advertising growth—and core to this thesis—is CTV. Small and mid-market advertisers are reallocating budgets from linear TV into CTV, a $60B opportunity over several years as linear spend fades. Unlike linear, which requires long-term commitments, programmatic CTV lets SMBs test and scale campaigns without multi-year contracts. Performance-focused buyers prize CTV’s real-time control, brand-safe environments and >90% ad-pod completion rates, driving higher ROAS—and Viant’s playbook is built for exactly that.

Viant’s patented Household ID is arguably superior to TTD’s UID2 in CTV because it manages reach and frequency at the household level. CTV devices are often shared, so targeting the entire household makes sense. For example, if one member (e.g., Tim) watches an ad on Hulu and another (Laura) later converts on mobile, Household ID links both actions to the same household. That accuracy improves with integrations of first-party CRM data and third-party sources—most recently a TransUnion partnership that boosts U.S. adult coverage to 95%. In a cookie-less world, advertisers concerned with privacy will drive incremental CTV spend through Household ID’s expansive coverage.

Viant reports that north of 80% of all ad requests leverage Household ID—and over 90% in CTV—far above any alternative identifier. Recent acquisitions like IRIS.TV bolster this edge: IRIS_ID’s AI-driven content classification adds brand suitability and contextual targeting to identity, enabling layered campaigns that reach a specific household watching relevant, safe content. In one Carl’s Jr. campaign pre-acquisition, IRIS.TV data produced a 35% lift in incremental visits and a 152% increase in incremental sales—evidence that combining contextual depth with Household ID drives meaningful ROI.

Another tailwind is falling CTV CPMs, driven by surging ad-supported inventory from new entrants like Amazon. Lower rates make CTV more accessible to Viant’s mid-market base, attracting incremental budgets and boosting gross ad spend on its DSP. Improved cost efficiency on high-ROAS placements lifts Contribution ex-TAC even if take-rates remain flat.

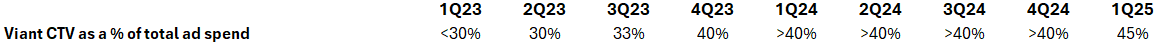

The other crucial element of Viant being a disproportionate CTV growth beneficiary lies in its Direct Access program, launched in early 2023. In an ad transaction there are primarily two intermediaries: the DSP, which represents the buyer (the advertiser), and the SSP, which represents the seller (the publisher). Like DSPs, SSPs also charge fees (no free lunch, of course) to both publishers and advertisers—pass-through costs that flow from the SSP to the DSP to the buyer. Viant’s Direct Access program connects the buyer directly with the publisher, effectively bypassing the SSP. In today’s programmatic landscape, multiple players add markup and drive up the cost of impressions. With Direct Access, Viant partners with many of the largest CTV content owners to bring inventory straight to its customers. Advertisers enjoy lower media costs, higher win rates in auctions and fewer instances of fraud—all contributing to better ROAS and campaign performance. By skipping SSP fees (typically ~10%), advertisers transact directly with publishers through Viant. That’s a win-win: publishers earn higher auction revenues, and advertisers pay less per completed view.

Direct Access is currently focused exclusively on CTV—because CTV is concentrated across thousands of apps versus millions of websites on the open web for other channels. Crucially, Viant does not charge for Direct Access; this move is designed to encourage incremental ad spend on the platform. Advertisers benefit from lower CPMs, and Viant captures more gross spend as a result. Viant’s decision to pass savings directly to customers—rather than charging for Direct Access—creates a clear competitive advantage. Management believes it’s better to encourage incremental ad spend and win customers from competing DSPs than to introduce friction by monetizing Direct Access.

Alongside new product launches, AI innovations and recent acquisitions, Direct Access has enabled Viant to attract larger mid-market accounts (towards the top-end of $50M–$1B in annual ad spend). Although Viant no longer discloses active customer counts, the shift toward higher spend is evident: customers generating >$1M in CXT over the trailing twelve months have grown by an average of 32% Y/Y over the last six quarters, and CXT growth across the top 100 customers has averaged 25% Y/Y over the same period.

Direct Access is a no-brainer for advertisers, which explains why it has rapidly grown to represent an increasing share of CTV ad spend:

You may wonder why Direct Access doesn’t exceed ~55% of CTV spend. The remaining 45% is split between Netflix—where Direct Access is not yet integrated—and a long tail of smaller streaming services whose inventory is more fragmented. As those smaller publishers adopt Direct Access, penetration will continue to climb. The key catalyst for further expansion is the Netflix integration, more on that in the next point.

Xandr DSP shutdown- the revenue opportunity calling Viant’s name

In May, Microsoft announced it will sunset its DSP, Microsoft Invest (formerly Xandr), by February 28, 2026. According to an internal memo previewed by Digiday, Microsoft deemed the current DSP model misaligned with its “AI priorities” and said it will consolidate all media buying into its new Microsoft Advertising Platform. In reality, Xandr struggled against entrenched walled gardens and the industry’s CTV momentum—Microsoft’s agentic aspirations could have been built into the existing platform but likely weren’t worth the investment.

From 2022 until early 2023, Xandr held an exclusive programmatic partnership with Netflix’s ad-supported tier. Under that model, advertisers had to transact through Xandr rather than open exchanges. When Netflix opened its inventory to additional DSPs after one year, many mid-market advertisers—unwilling to pay large DSP’s higher fees—favored smaller DSPs.

Xandr’s shutdown creates a greenfield opportunity: industry experts estimate $600M–$800M in annual ad spend currently runs through Xandr; roughly half of that is Microsoft-owned inventory ($300M–$400M) which will migrate to Microsoft’s new platform, leaving another $300M–$400M up for grabs, which is predominantly CTV. Xandr’s customer base skewed toward mid-market advertisers, the same segment Viant targets.

Viant is poised to capture this spend thanks to its CTV focus, Household ID and IRIS.TV-driven ROAS advantages. A further catalyst will be Direct Access integration with Netflix. Today, Viant is a partner DSP but lacks a Direct Access connection because Xandr’s own SSP, Monetize, previously handled that traffic. As Xandr sunsets and ad spend migrates away, Viant’s pending Direct Access integration is poised to attract Netflix advertisers seeking ~10% savings on fees.

Quantifying the opportunity based on the following assumptions, this represents a $51M revenue opportunity available for capture over the next two years.

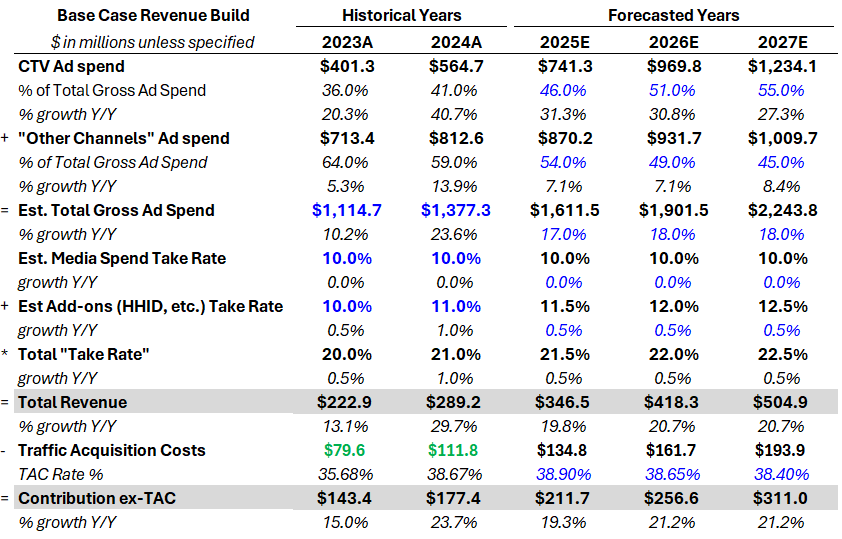

Revenue Build

Piecing the top-line thesis together, Viant’s revenue model has two inputs: gross ad spend and the take rate applied to that spend. P14’s take rate assumption for FY24 is 21%—+100bps from FY23. Based on that take rate, gross ad spend is backed out from reported revenue for historical periods.

In the base case, CTV ad spend will be the major growth driver. AI products that simplify mid-market CTV campaigns (AI Planning), best-in-class addressability (Household ID) and contextual targeting (IRIS_ID) should attract new CTV budgets. Direct Access remains a no-cost, high-value solution, and the $245M Xandr ad spend opportunity adds another catalyst. Combined, these tailwinds support a ~30% CAGR in Viant CTV ad spend over the next three years—roughly 2x the market’s expected growth. CTV expansion is still in its early innings as ad-supported streaming matures.

On the other hand, Other Channels ad spend—including high-growth streaming audio (~10% of mix), DOOH (low-single digits), mobile/social (low-double digits), open-web display (low-single digits) and digital billboards (10–15% of mix)—faces mixed dynamics. In light of potential macro uncertainty, a ~7.5% CAGR in Other Channels over three years seems prudent: stronger streaming audio and DOOH growth offset by pressure on search, social and traditional display as advertisers reallocate to higher-ROAS channels like CTV.

On take rates, the gross-media-spend fee is modeled holding at 10%, preserving appeal to small/mid-market advertisers. Add-ons (AI features, Household ID, IRIS_ID) are assumed to drive a conservative 50bps annual increase. As a result, total take rate rises from 21% in FY24 to 22.5% by FY27.

All told, these inputs yield a ~20% CAGR in total revenue over the next three years. FY25E revenue growth is modeled at +19.8% versus the +17.2% analyst consensus.

Likewise, Contribution ex-TAC is forecast to grow at a +20.5% CAGR. Direct Access savings and the shift from managed service to self-service should normalize TAC rates, though new mid-market managed-service clients will offset some gains. Post-2025, TAC rate savings of ~25bps annually are expected. Reflecting the cautious Q2 guide (14–19% growth), CXT is modeled at +19.3% Y/Y in FY25E, slightly below total revenue growth.

Speculative upside—Google AdX breakup

Note that although this potential catalyst is already starting to be priced into valuations of SSPs like Magnite and PubMatic, Viant’s stock shows no such uplift. Following a district court ruling that affirmed Google’s ad-tech monopoly, the DOJ is pursuing remedies that could spin off Google AdX (and related DoubleClick assets) into an independent SSP. Were that divestiture to occur, the new SSP would likely form partnerships with third-party DSPs—opening YouTube inventory to platforms beyond Google’s DV360. For Viant, this could translate into direct access to premium YouTube reach, the opportunity to win spend currently locked in Google’s walled ecosystem, and a more level competitive playing field. While no binding timeline exists and regulatory outcomes remain uncertain, the lack of any AdX-breakup premium in Viant’s valuation—despite being baked into some SSP peers’ multiples—represents true optionality: should Google be forced to spin off its exchange, Viant stands to capture outsized upside from newly available YouTube ad dollars.

Well positioned for profitable growth

In every profit-inflection story, operating leverage is a key driver. With incremental ad spend on the platform poised to grow, the market overlooks Viant’s ability to leverage cost of sales (TAC) and opex. This oversight likely stems from a recent rise in TAC as a % of revenue (TAC rate), which the market misreads.

Viant’s business is roughly 85% self-service (advertisers’ in-house teams buying ad space) and 15% managed service (Viant’s traders executing buys). The TAC rate has ticked up in recent quarters because new logos often start under managed service—handholding that drives retention and differentiates Viant from TTD’s self-service-only model. As advertisers become certified and comfortable, they transition to self-service, shifting reporting from gross to net accounting and lowering TAC %. Political ad dollars (captured in 3Q and 4Q every two years) also inflate TAC rates, since these campaigns are usually managed service. As political spend fades this year and managed-service clients migrate to self-service, TAC rates should decline.

Despite higher TAC rates, Contribution ex-TAC has grown >20% Y/Y for seven consecutive quarters, fueled by incremental spend from existing clients and new managed-service wins. Further CXT tailwinds will come from platform/data fees—AI Bidding CXT surged 75% Y/Y in 1Q25—Household ID, IRIS.TV and Direct Access savings (bypassing ~10% SSP fees). Post-FY25, the base case calls for only 25bps of TAC rate improvement annually, as onboarding new managed-service clients partially offsets savings.

On opex, Sales & Marketing spiked 4% of revenues QoQ, reflecting typical Q1 budget planning, plus incremental costs from IRIS.TV (closed Nov 2024) and Lockr (Feb 2025) acquisitions. Management expects high operating leverage in S&M—revenue can grow significantly with minimal headcount increases. Similar leverage applies in Other Platform Operations and G&A, where acquisition-related costs will normalize later in the year.

Despite nine consecutive quarters of >30% Y/Y adjusted-EBITDA growth, the market still underappreciates Viant’s operating leverage—likely to become evident once GAAP EBIT consistently inflects, driven by top-line strength and opex leverage.

EBITDA Build

The P14 base case anticipates operating margin (% of revenues) to expand 165 bps in FY25E, 230 bps in FY26E and 330 bps in FY27E, reaching a terminal 8.45% GAAP operating margin. While a 725 bps margin expansion from FY24A to FY27E may seem aggressive, it is achievable given Viant’s business model and revenue tailwinds.

Incremental SG&A to support a ~20% top-line CAGR is minimal. On the S&M side, most selling costs are semi-fixed: an experienced direct-sales team handles both new-logo acquisition and account expansion using a consultative, training-focused approach (Programmatic University and ongoing certification) rather than expensive demand-gen campaigns. Dedicated customer support and optimization services further drive adoption without significant headcount increases. As more revenue flows through existing account executives and self-service channels, only marginal commission and support-staff increases are needed. FY25E S&M at 18.08% of revenues is artificially high due to acquisition costs; 100 bps of savings are forecast in FY26E and 150 bps in FY27E.

A similar pattern applies to G&A: FY25E at 17.17% of revenues will normalize by 80 bps in FY26E and 130 bps in FY27E as acquisition-related costs decline. Technology & Development will see the least leverage, as ongoing investments in CTV addressability (Household ID and IRIS_ID) and Viant AI are required. As clients shift from managed service to self-service—driven by AI automation—headcount needs will decline. Tech & Dev is expected to represent 8% of revenues in FY25E, dropping 5 bps thereafter.

Overall, opex is forecast to grow at a 14.8% CAGR over the next three years versus +6.5% Y/Y in FY24, making these operating-leverage assumptions conservative. Management targets 10–12% Y/Y SG&A growth ex-acquisitions; this base case conservatively models a 15.2% CAGR.

Resulting EBITDA

FY25E: $55.2M (+24% Y/Y) at a 15.9% margin of revenues ( +57 bps) and 26.1% of CXT ( +103 bps), vs. consensus $54.1M.

FY26E: $72.2M (+31% Y/Y) at a 17.3% margin of revenues ( +131 bps) and 28.1% of CXT ( +202 bps).

FY27E: $100.7M (+40% Y/Y) at a 19.9% margin of revenues ( +270 bps) and 32.4% of CXT ( +427 bps).

By FY27E, Viant’s 32.4% CXT margin approaches The Trade Desk’s 41.3% and could reach 40% in a bull case—validating the company’s path to TTD-like profitability over three to five years.

Valuation

Given Viant’s growth phase—driven by CTV adoption and the pricing-model transition over the past two years that led to underperformance in 2022—the market now prioritizes top-line growth over profitability. Accordingly, in a multiples-based valuation, EV/Sales is given a 60% weighting and EV/EBITDA a 40% weighting.

The base-case valuation does not factor in a major shift in investor perception of Viant’s story. The company has stepped up IR—attending more conferences and securing additional analyst coverage—to amplify its profile. Early underperformance in 2022, due to the pricing-model transition, combined with the looming presence of TTD, creates misunderstanding and embedded conservatism in the current valuation. As Viant’s AI successes gain visibility and its margin profile converges toward TTD’s over the next 3–5 years, the market will begin to view Viant as a “mini-TTD.” Given TTD’s rich valuation, even modest multiple expansion toward TTD levels would unlock significant upside.

Despite superior growth (+33% Y/Y in FY24 vs. TTD’s +29%), Viant trades more like slower-growth SSP peers. The gulf in EV/Sales multiples—reflecting the market’s mispricing of Viant’s business—is clear in the comps below:

Base Case:

If my base case plays out and revenue and CXT both grow at ~20-21% for the next 3 years, Viant should experience a very conservative given the level of growth bump to 3x EV/Sales, this is very very conservative for a 20%+ top-line grower. A 3x EV/Sales on FY26 estimates implies 69% upside in less than 2 years. A 3x EV/Sales corresponds with a ~4x EV/CXT multiple.

On EBITDA, if Viant delivers 100 bps of CXT-margin expansion in FY25 and 200 bps in FY26—implying +24% Y/Y in FY25E and +31% Y/Y in FY26E—a 15x EV/EBITDA multiple is more than justified (below the 17x post-FY24 results level). At 15x, that implies ~49% upside from current levels. The base case assumes modest cash generation and continued share repurchases, reducing diluted SoS (Class A + Class B) by ~1% annually.

Taken together in a 60/40 blend, the P14 base case yields an FY26 PT of $21.39/sh, implying 61% upside in under two years.

Bull Case:

In a bull case, revenue grows at a 27% CAGR over the next three years—driven by a 21% CAGR in ad spend and 110bps of annual take-rate expansion as add-ons like IRIS_ID are monetized more fully. If that materializes, the EV/Sales multiple could re-rate to 5x—still well below TTD’s 13x. On EBITDA, the bull case assumes 1,054bps of margin expansion to a 35.6% CXT margin by FY26E, implying +63% Y/Y growth in FY25 and +43% Y/Y in FY26. Under these conditions, the EBITDA multiple could expand to 18x. The bull case also anticipates significant cash generation and potential sales-cycle shortening, which would further benefit working capital.

Taken together in a 60/40 blend, the P14 bull case yields an FY26 PT of $37.16/sh, implying 180% upside in under two years.

Bear Case:

In a downside scenario—driven by prolonged macro uncertainty, a sluggish shift from linear TV to CTV, aggressive price competition compressing take rates, elevated churn, rising opex as a % of revenue, weak AI-product adoption, and increased cash burn—revenues could shrink to a 13% CAGR over the next three years. Under those conditions, EV/Sales might collapse from today’s 2.2x to 1.5x—levels not seen before. EBITDA would suffer a –1.4% CAGR, with CXT margins compressing by 286bps on average annually, likely pushing EV/EBITDA down to 10x.

Taken together in a 60/40 blend, the P14 bear case implies a –28% downside to $9.61/share.

Risks

The items highlighted in the bear case are almost draconian. But as with any investment, there are risks that should be considered, some are:

Adverse Macro: Should a slowdown in advertising spend materialize, Viant will be impacted. However, the effects will be less severe than expected given the shift into resilient CTV channels and a more diversified customer base since 2022. Top verticals like healthcare are even increasing CTV budgets—Nielsen’s Global Annual Marketing Survey finds 60% of healthcare and pharma companies plan to boost CTV spend this year. A broader advertising downturn would still hit Viant harder due to its SMB focus, but current trends remain performance-driven, where Viant’s best-in-class addressability solutions and CTV expertise offer a competitive edge.

Small free float—a double-edged sword: Out of 63M shares outstanding (Class A + Class B), only 15M trade publicly, creating genuine liquidity constraints for large institutional investors. Yet with roughly 8% of the float sold short, positive catalysts or earnings beats can trigger outsized near-term rallies. An 8% short interest isn’t extreme but merits monitoring. The biggest liquidity risk is a potential secondary offering—management’s choice if they wish to raise awareness and capital. While secondaries are typically seen as bearish, timing is key. Management is likely to wait until the market recognizes Viant’s execution and the multiple expands from current depressed levels.

Downward pressure on take rates: Viant’s take rates run north of 20%. Some argue that if TTD cuts its rates, Viant would suffer. That view overlooks TTD’s SMB clients, who likely pay way above 20% to offset deep volume discounts for its largest advertisers. Competition also comes from newer DSPs pivoting toward CTV, but Viant’s Household ID and IRIS_ID deliver true household-level granularity—critical in CTV and unmatched by peers. Nevertheless, competitive pressures warrant close monitoring.

Summary Base/Bull/Bear Cases:

In summary, as a GARP adtech, I view the risk/reward as compelling enough to initiate a mid-size position in the P14 Capital portfolio, with dry powder ready for market turbulence.

Thank you for reading P14 Capital! If you’ve found value in the research, consider supporting my work by buying me a coffee.

Disclaimer: Nothing posted by P14 Capital should be considered financial advice. The author of this post holds a long position in DSP. Please consult a financial advisor and/or conduct your own due diligence before making investment decisions.